Now is the time for investors and property buyers looking for newly constructed properties to purchase greenfield developments. As from here on out, it is going to get significantly more expensive due to soaring raw material prices. This is according to Chris Renecle, the MD at Renprop, a Johannesburg based developer and rental manager.

“On new builds or future builds there will be an inflationary increase so buy now at current prices. In the coming years, you will be paying significantly inflated prices,” says Renecle. He adds that more and more inflationary pressure is going to be brought to bear on new residential property builds in the future thanks to much higher input costs due to the fallout around the Covid-19 pandemic.

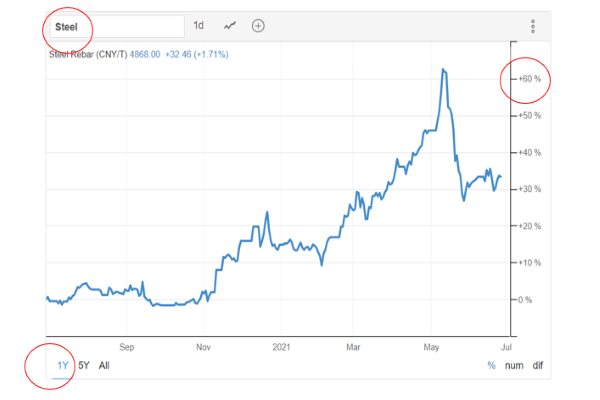

“Construction prices have already increased dramatically with raw materials prices, such as concrete and steel, all on the up. In fact steel prices have gone up some 50% in the last year, despite demand for new builds in the residential market being generally low,” says Renecle.

According to the CRB Commodities Index1, steel rebar prices were 60% higher on May 12, 2021, than they were the same time last year. They were sitting nearly 30% higher on June 27, compared with last year.

American-British information provider, IHS Markit2 predicts that steel prices will remain elevated and supply chain disruptions will delay price declines into the second half of 2021. Steel of course is just one of the raw materials that is expected to come under increasing inflationary pressure.

Renecle says there is also a shortage of bricks, aluminium, and glass because of production slowdowns due to the Covid-19 pandemic. All of this creates a price premium with the costing of all recent development tenders for Renprop being considerably higher than they were previously.

Mining vs construction

Another problem for the construction sector is that it is competing with the mining industry for raw materials such as steel.

The mining sector, which is experiencing a boom at the moment, is snapping up all the available steel that comes to market, while at the same time there has not been enough local steel production to keep up with the demand.

While there has been little activity as far as new developments in the general commercial property sector is concerned, residential real estate is still experiencing pockets of demand.

“But even though demand isn’t where it should be at the moment, this won’t keep prices from rising,” explains Renecle.

His advice to those wanting to get into the residential market is to do so while they still can. This is particularly true for those wanting to purchase investment properties as expected higher prices are going to eat into any potential future returns.

Strong rental returns

As it stands, Renecle says the properties that are best placed at the moment to provide strong rental returns for investors are those priced between R800,000 and R1m, particularly two-bedroom, one-bathroom apartments with open planning living.

Renecle says this price range is the sweet spot at the moment, based on rental demand and generally provides the strongest rentals for investors.

New developments

Renprop, which recently introduced a rental guarantee product that delivers an 8% net return to investors that beats money markets, says there is healthy demand at two of its new developments, which are both in the R800,000 to R1m price range.

These include Fern Valley Apartments in Ferndale, which borders Bryanston, where two-bedroom units are selling from R799,000 and Brooke Manor in Rivonia, where the group is selling two-bedroom units from R979,000.

“Both new developments have rental guarantees in place, which offer comfort to investors in difficult times. This means the developer guarantees a rental income for an investor buying a property. Typically this is set between 6-12 months depending on the value of the property and mitigates the risk for investors wanting to enter the buy to let market. At the same time investors do not have the hassle of finding their own tenants with Renprop securing them and making sure investors earn rental income from day one after transfer,” concludes Renecle.

Writer : Chris Renecle

References: