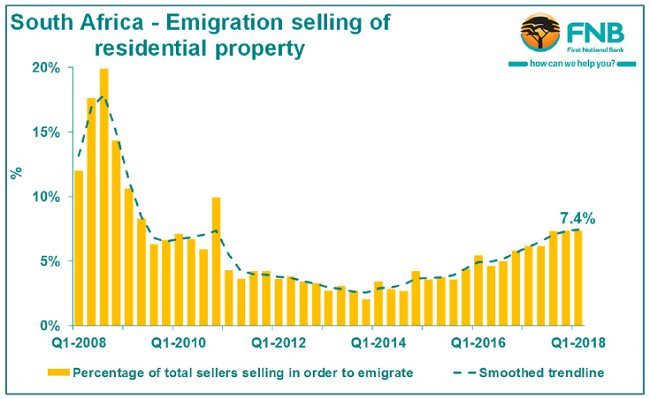

Statistics from FNB show that the emigration-related selling was still high in the first three months of 2018, in spite of the improved political and economic outook.

The 1st Quarter 2018 FNB Estate Agent Survey pointed to a virtually unchanged estimated rate of emigration-related home selling, following a prior a multi-year rising trend which started back in 2014. This leaves the rate of emigration selling somewhat “elevated”.

In the survey, agents are asked to provide the main motives for people selling their properties. One of the 8 key motives for selling homes is the “Selling in order to emigrate” motive.

Expressed as a percentage of total home selling, selling in order to emigrate reached its lowest level back in the final quarter of 2013, at an estimated 2.0% of total home selling.

This selling motive gradually rose, reaching 7.4% of total selling by the 4th quarter 2017 survey. The 1st quarter of 2018 then returned an unchanged estimate of 7.4%.

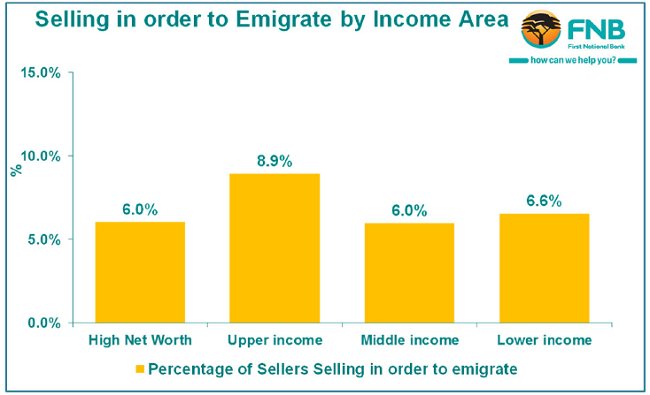

Selling to emigrate by income area

In the survey, agents break down the market into 4 “Income Areas”. The 4 income areas are:

- High Net Worth Areas (average house price = R3.53m)

- Upper Income Areas (average house price = R2.81m)

- Middle Income Areas (average house price = R1.79m)

- Lower Income Areas (average house price = R1.18mm)

- The emigration rate was fairly well spread across all 4 income areas early in 2018, although it was at its highest in what agents term the

“Upper Income” Area segment.

The High Net Worth Areas returned an emigration-related selling estimate of 6% of total selling, but it was in the slightly lower priced segment, i.e the Upper Income Area segment, where the highest estimate, i.e. 8.9%, was to be found. Middle Income Areas recorded a 6% estimate and Lower Income Areas 6.6%.

Sentiment has improved, so why is emigration still high?

There has been an improvement in general sentiment in South Africa in the 1st quarter of 2018, as witnessed in a relatively solid Rand performance compared to much of last year, and a jump in the 1st quarter RMB-BER Business Confidence Index. In the FNB Estate Agent Survey, agents also perceived a major jump in “Positive Consumer Sentiment” in the 1st quarter of this year, and many report it to be as a result of the recent political leadership change in the country.

So why have we not seen decline in the highly sentiment-driven emigration-related home selling rate yet? Part of the answer is probably that there is something of a lag time before we begin to see the impact of improved sentiment on emigration-related selling, because emigration has a long planning phase for households. Therefore, the relocation decisions of those 1st quarter 2018 emigration-related sellers have probably been made a considerable time ago.

We therefore still expect to see some decline in the emigration-related selling percentage in the quarters to come. However, we would not anticipate the percentage receding all the way back to the 2% low of late-2013 just yet. Although sentiment appears to be greatly improved in SA early in 2018, economic performance of the country plays a key role in emigration levels, with many highly-skilled labour force participants assessing local economic opportunities relative to those abroad when making their decisions. And while we anticipate a mildly improved real economic growth rate of 1.8% in 2018 (compared to 1.3% in 2017), such a growth rate remains weak.