In a world of instant gratification, the idea of delaying a home purchase until you’ve saved up a deposit sounds positively antiquated to many people - but there’s nothing old-fashioned about the amount of money to be saved by doing just that, says Rudi Botha, CEO of SA’s leading bond originator BetterBond*.

“Of course no-deposit or 100% home loans do make it easier for young buyers and first-timers to get a quick start in the property market, and over the past 10 years, they have once again become more readily available, especially to buyers in the affordable home sector.

The cost of home loans

“However, it is important to understand that 100% loans come at a high long-term cost and that with home price increases currently running behind the rate of inflation, there is less pressure to get into the market quickly and all the more reason to save and put down a deposit of 10% or even 20% of the purchase price.”

In the first place, he says, this will make it easier to qualify for a home loan. “If you were buying a R1m property and could put down a 10% deposit (R100 000), for example, the gross household income required to qualify for a bond at the current prime rate of 10% could drop from around R32 000 a month to around R29 000, depending on your other monthly expenses.

How you'll save

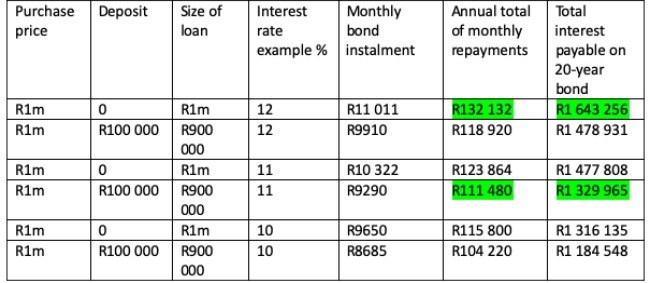

“In addition, the minimum monthly bond repayment will fall from R9650 to R8685, which will immediately make your home more affordable on a month-to-month basis, and reduce your household expenditure by almost R12 000 a year.” (See table below.)

In fact, says Botha, it would probably save you much more than that, because 100% loans are usually only granted at interest rates well above prime. Putting down a substantial deposit will not only increase your chances of loan approval but also put you in a strong position to secure a much lower interest rate because it makes you a lower-risk borrower for the banks.

“So if you are approved for a R1m home loan with no deposit, the interest rate might be 12%, for example, while paying a R100 000 deposit might enable you to secure a R900 000 home loan at an interest rate of 11% or even less, depending on your personal financial profile. And the difference that could make to your current and future finances is really significant.

“Taking that example, the table below shows how the smaller home loan (after payment of a 10% deposit) plus a 1 percentage point difference in the interest rate charged could translate into annual savings of more than R20 000 on your home loan repayments, plus a saving of more than R300 000 on the total interest payable over the lifetime of your bond. That would be a worthwhile return on the R100 000 initially invested in your home as a deposit.”

Potential savings when paying a deposit

Source: BetterBond

And finally, he says, saving a deposit puts homebuyers in a better position to weather any future financial difficulties. “If someone with a new 100% home loan were suddenly to lose their job, for example, and had to sell their home in a hurry, there would be selling costs and agent’s commission to pay as well as the 100% loan to repay, so they could quite easily end up owing more than the sale price of their property.

“The buyer who had paid a 10% or 20% deposit would obviously be able to cope much better in this situation – and it is worth noting that they would also be in a better position to cope with any future rate increases, or to start paying their home off more quickly if interest rates should fall.”

To conclude, it pays to wait a little longer when buying a home, and save up for a deposit.