The most important financial institution in any monetary economy is the central bank. South Africa's central bank is the South African Reserve Bank (SARB), which was established in 1920. The SARB's five main functions are:

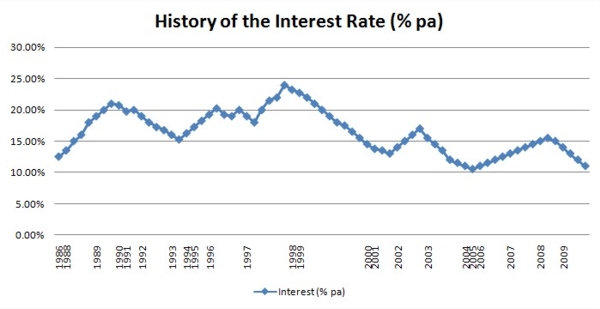

As the bankers' bank, the SARB, among other things, acts as 'lender of last resort'. The SARB is willing to meet any cash balance shortage experienced in the money market. When, for example, people are collectively borrowing more from the banks than they are investing, the banks also experience funding difficulties and they borrow money from the SARB, by way of a repurchase or 'repo' transaction. This means that the banks sell certain of their financial assets to the SARB and promise to repurchase the assets from the SARB within seven days. The more debt you have… The Interest Rate is a term used to represent all the individual rates charged in the country's lending and borrowing process. The rate that plays the most dominant role in determining the Interest Rate is the Repo Rate. The Interest Rate also includes the Prime Lending Rate of Banks, the Bankers' Acceptance Rate and the Rate on Government Stock, to mention a few. When the SARB increases the Repo Rate, the banks usually increase their Prime Lending Rate accordingly, and a decrease in the Repo Rate will result in a decline in the Prime Lending Rate. Here's a look at the Interest Rate, dating back 23 years:

This article was provided by |

Property Advice

.

.