Despite hopefully being near the peak of the interest rate hiking cycle, South Africa’s residential property market remains supported by underlying fundamentals – most notably the fact that overall demand continues to exceed supply. This is perhaps particularly evident in the Western Cape, which is characterised by high demand and stock shortages, while Johannesburg has stock available with less demand – yet both markets function and demonstrate ongoing resilience.

Bearing in mind that while the interest rate has recently been at historic 50-years lows and is now just above pre-Covid levels, it is hoped that the market is reaching the end of the increases, as the interest rate environment is understandably the single biggest influencing factor in the market. While one cannot generalise regarding SA’s residential property market, as it is comprised of vastly differing sectors and neighbourhoods, impacted by differing dynamics and trends, there are still pockets of excellence.

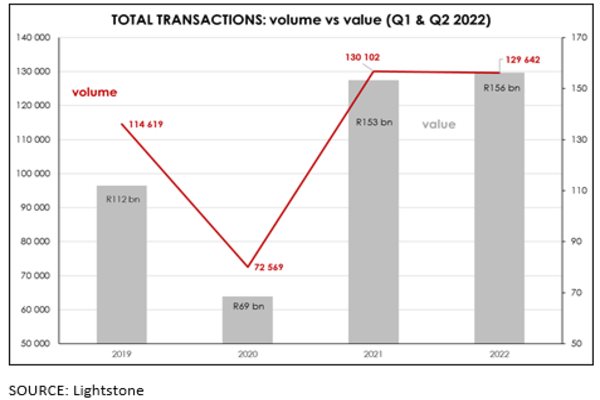

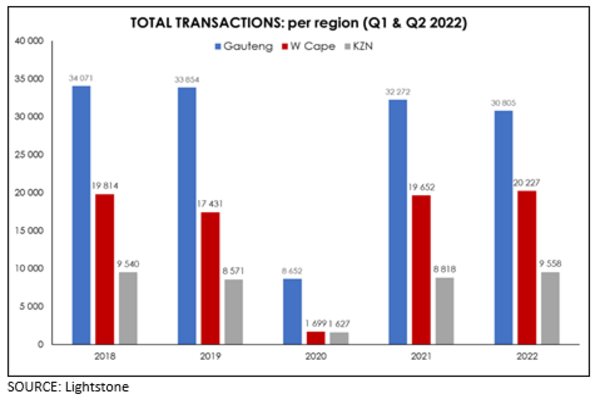

While nothing like the global boom, South Africa’s housing market also experienced a post-pandemic boom in 2021 and 2022 in both volume (units sold) and value (see chart below). Locally, the increase in prices was relatively muted, and given several years of single digit price increases (and decreases from year-earlier levels in real terms) SA’s housing market overall is unlikely to be overvalued and in bubble territory – although still vulnerable, to a degree, to a slowdown in activity.

On balance, although the local housing market is facing a number of headwinds (both global and local) it is not facing the risks of a significant price correction as seen in other countries across the globe. For example, the Union Bank of Switzerland (UBS) recently warned that numerous cities in America, Europe and Asia are now in overvalued territory after double digit price increases since mid-2021, with many now facing the serious risk of price corrections.

According to Lightstone, total residential unit sales in SA declined by -0.35% in H1 2022 from year-earlier levels, while the volume of bonded sales dropped by -8.1%. In contrast, the value of sales rose by 2.0% (+R3bn).

While the total number of homes sold during H1 2022 was marginally lower than during the same period in 2021, it remained elevated (+13.1%) compared to the pre-Covid period during 2019. In contrast, the value of homes sold during Q1 2022 was higher than the same period in 2021 – presumably reflecting the fact that the second wave of home buying triggered by the pandemic was mainly fuelled by more affluent homeowners taking advantage of the low interest rate environment to purchase larger, freehold homes with more space (for those now working from home) or to semigrate to a coastal region.

From a Pam Golding Properties perspective, sales turnover for the year to end October 2022 is consistent with the previous year with increased turnover of 32.8% in the price band above R6 million, while residences sold in the R3 million to R6 million price band increased by 29.3% in turnover, and total transactions up to R3 million increased in sales value by 37.9%.

Increased demand for luxury homes

As far as the luxury end of the market is concerned, we have seen an increased demand for high-end homes in excess of R20 million and upwards of R30 million to R80 million and beyond. These include residences sold in areas such as Sandton, Dainfern and other Northern Suburbs of Johannesburg, Steyn City in Fourways, and in Cape Town - Clifton, the V&A Waterfront, Bakoven, Camps Bay, Bantry Bay and Mouille Point on the renowned Atlantic Seaboard, and Constantia and Bishopscourt in Cape Town’s Southern Suburbs. This high-end segment of the market is characterised by buyers both South African-based and international who have decided to invest in iconic, lifestyle properties – many of whom have elected to live or spend more time in the Cape. The entire Atlantic Seaboard has experienced a surge in confidence and top-end buyer activity. Coupled with this, in Gauteng, we are experiencing a great deal of interest in top golf estates such as Blair Atholl, Dainfern, Eagle Canyon, Ebotse and Serengeti.

Most international buyers mention that the value offered by properties here is significant and the lifestyle is compelling – ranking with the best on offer elsewhere in the world, while this segment of the market remains unaffected by interest rate hikes. Buyers with meaningful resources are also keen to diversify their investments while simultaneously benefiting from living in properties providing outstanding views, lifestyle and amenities.

The number of international buyers in the last 12 months comprised 4% of our total buyers purchasing existing homes, with an average price of R5.85 million. Our international buyers are from numerous countries spread across the globe, with the top 10 being Germany, the UK, Zimbabwe, USA, the Netherlands, Switzerland, Botswana, France, Nigeria and Congo.

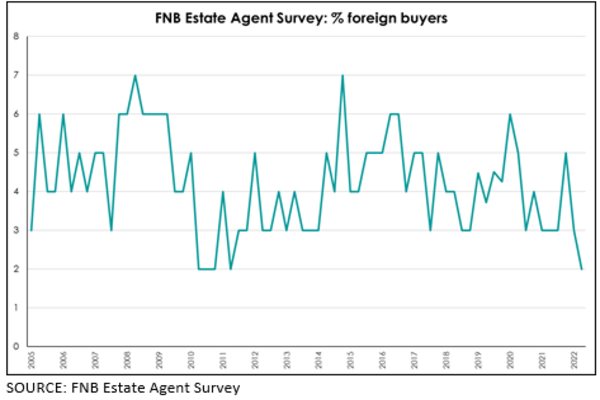

According to an FNB Estate Agent Survey, while nearly 6% of sales across the SA housing market were to foreign buyers during the initial stages of the pandemic (H1 2020), this has eased to less than 3% during the first half of 2022.

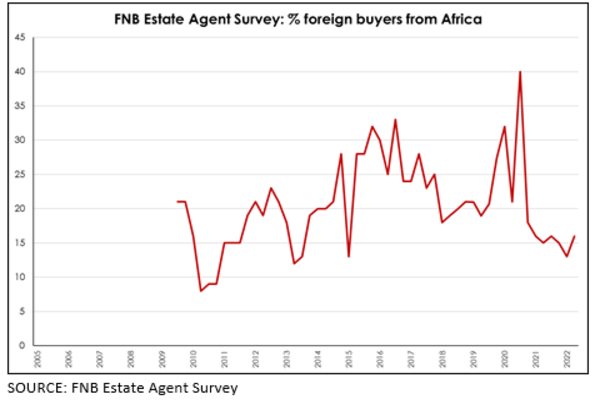

Also according to FNB, the percentage of those buyers who originated from the African continent soared to 40% in Q3 2020 but has since eased – averaging 14.5% during the first half of 2022.

Factors underpinning SA housing market

A number of factors continue to underpin the local housing market:

- Banks continue to compete for market share, ensuring that lending conditions remain supportive, particularly low/zero deposits and competitively priced home loans.

- Demographic underpinnings are provided by a young population profile and rapid growth in the number of households.

- Due to the rising cost of fuel and living, with remote working being phased out in some instances, housing market activity is being boosted by the need to live closer to work, school and amenities

- People are still buying, selling and relocating for all the usual reasons, most notably changing lifestyles

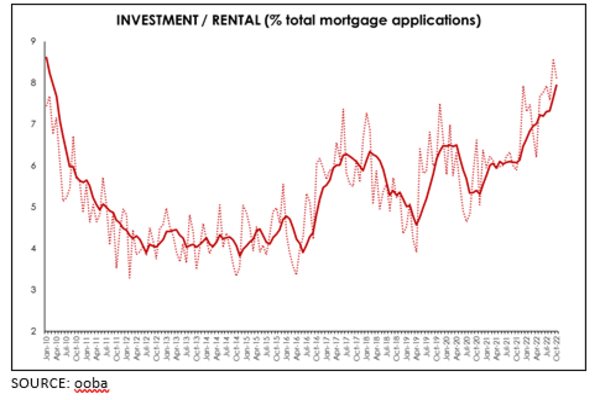

- Rising interest rates has seen renewed demand for rental properties, prompting a renewed demand for buy to rent and/or investment homes.

Regional Markets

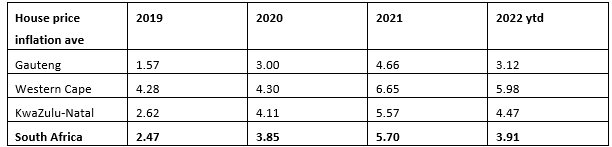

The Western Cape housing market has registered the strongest growth among the three major regions during the past four years, including the year to date, with KZN following in second spot. Although Gauteng has underperformed relative to the national average in all four years, house price inflation in all three major regions has been stronger in the three years since Covid first hit the SA economy.

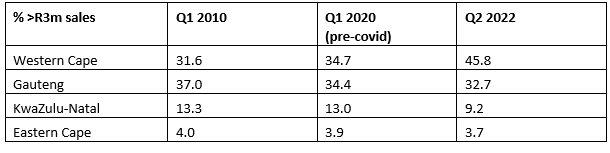

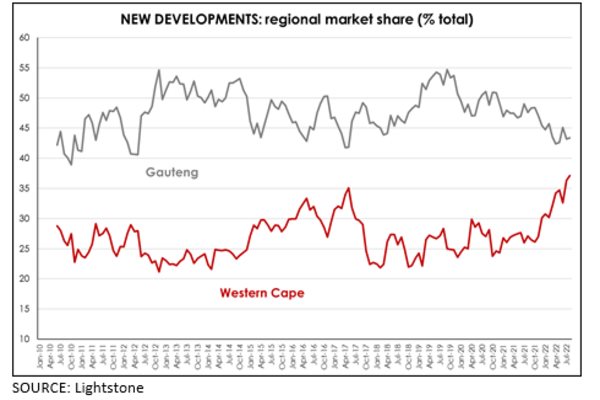

While unit sales in Gauteng have failed to rebound to pre-Covid levels, in the Western Cape and KwaZulu-Natal H1 2022 sales exceeded the same period in 2018, 2019 & 2021. Highlighting the higher average purchase price for homes in the Western Cape, in Q2 2022, Gauteng accounted for 37% of unit sales vs W Cape at 24% - yet both accounted for 36% (R31bn) of sales value.

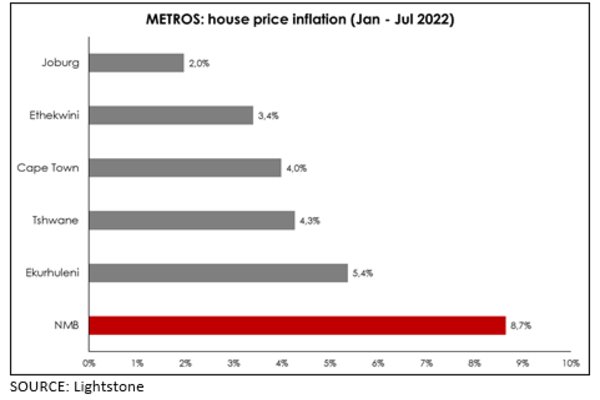

Metro markets

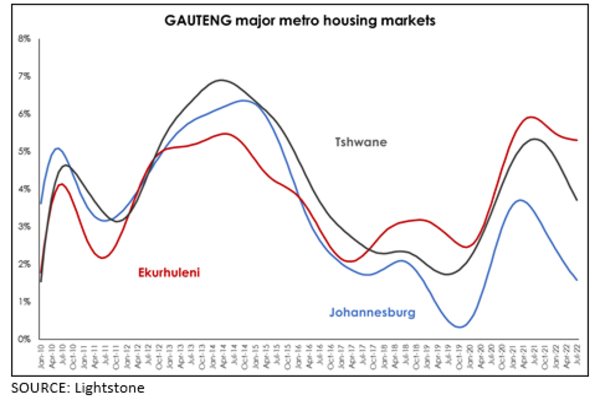

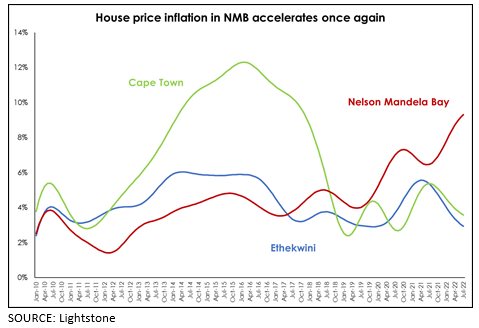

House price inflation in all metro housing markets is losing momentum – with the exception of Nelson Mandela Bay where growth in prices has accelerated since mid-2021. Ekurhuleni has shown signs of stabilising at a relatively high level – underpinned by first-time home buyers as homes remain more affordable in this region.

Within Gauteng, Ekurhuleni is showing greater resilience in price performance than Johannesburg and Tshwane, with house price inflation showing signs of stabilising at around 5.3%. The market may well be benefiting from its status as a more affordable destination than Johannesburg and Tshwane.

Among the coastal metros, NMB is an outlier, with growth in prices accelerating even as the major metro and regional markets are showing a slowdown in growth in house prices.

Among the coastal metros, NMB is an outlier, with growth in prices accelerating even as the major metro and regional markets are showing a slowdown in growth in house prices.

Home buying trends

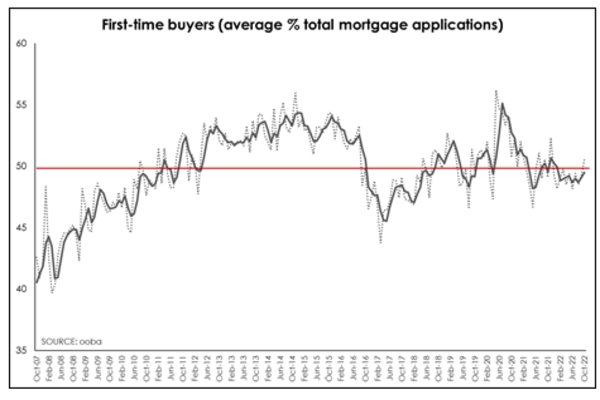

First-time buyers are typically more sensitive to a rising interest rate environment – as they are they are normally at the early stages of their careers and have fewer financial resources for deposits and associated costs of home ownership. As a result, we have seen the post-pandemic boom in first-time home buyers moderate with applications now stabilising just below 50%.

Positively, three measures of banks’ appetite for lending to the market include:

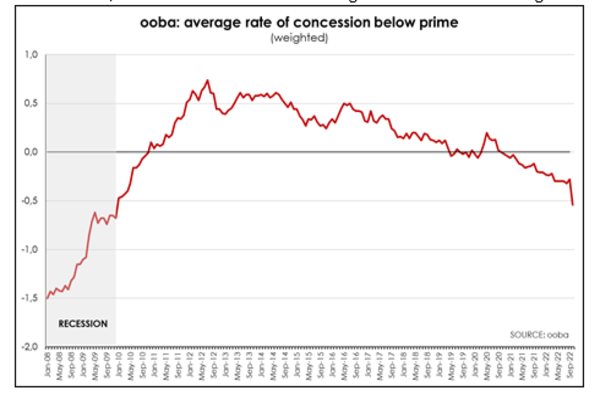

- Pricing of loans – ooba’s average concession below prime improved sharply in October 2022, shifting to -0.54% from -0.28% in September. This is the most competitive pricing seen since the final years of the 2008/09 recession in the wake of the global financial crisis and goes some way towards making home loans more accessible for South African home buyers.

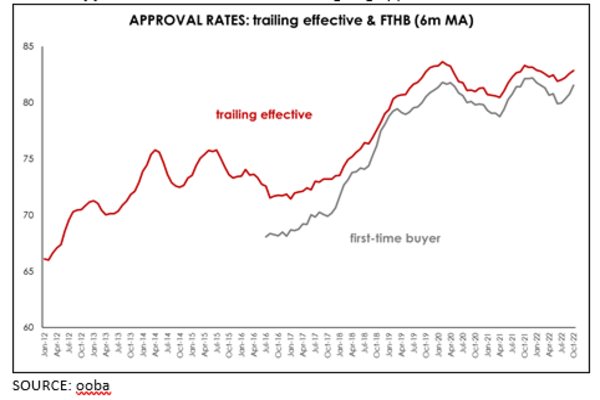

- Approval rate – this reflects the ongoing appetite of banks to extend mortgages, as well as the quality of applicants.

Approval rates declined during the first year of the pandemic (Apr 2020 – Apr 2021) but then rallied. In the case of first-time home buyers, the approval rate exceeded the pre-Covid highs briefly in late-2021. While there was a second slowdown in approval rates during the first half of 2022, they are increasing once more. Both the trailing effective and the FTHB approval rates remain elevated just below pre-Covid highs.

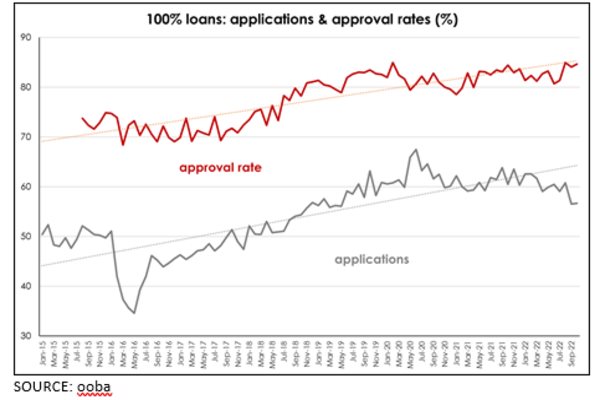

Furthermore, while approval rates for 100% loans drifted lower during 2020, they have rebounded and are currently at similar levels to pre-Covid highs of nearly 85%. Approval rates have remained above the 84% level for three consecutive months. What has changed is the percentage of applications which are for 100% loans. After spiking in the wake of the aggressive interest rate cuts (67.5% in June 2020) they have drifted lower, particularly in the wake of the series of interest rate hikes since late 2021.

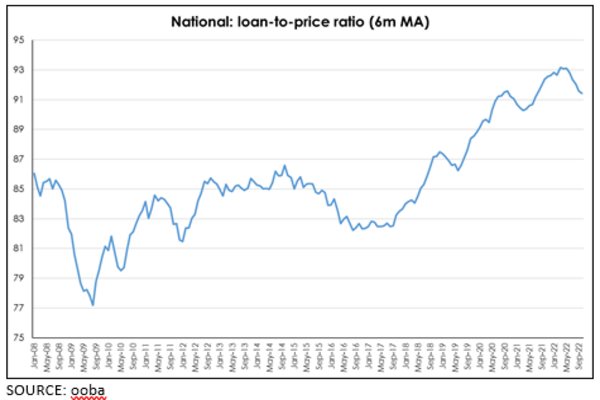

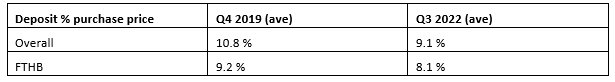

- Deposits - one indicator which does appear to have shifted is deposits as a percentage of purchasing price. After rising above 93% during the first half of 2022 (6m moving average), the loan-to-price ratio has since declined to 91.4% in October. This is the first sign that the banks are becoming slightly more cautious.

Interestingly, FTHB deposits were lowest in Q2 2020 at 6.0% of purchase price while overall deposits reached their low point in Q1 2022. Nonetheless, both remain below pre-Covid highs – the average rose to 8.6% in October (6m moving average) while for FTHB it increased to 8.2%.

Other Key Trends

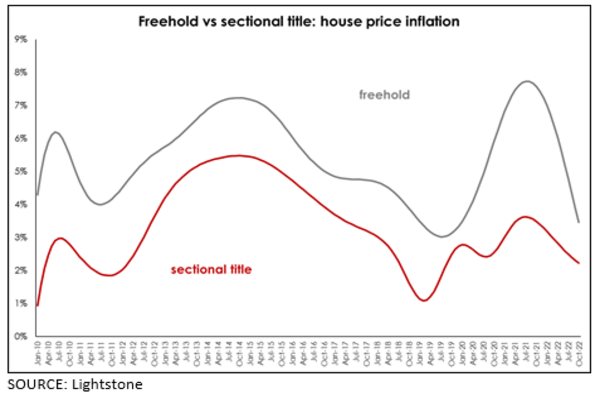

Return of Sectional Title: The surge in demand for freehold properties triggered by the pandemic – amidst a fear of shared spaces – appears to have faded and the desire for sectional title has continued.

In October, growth in freehold prices had slowed to 3.47% compared to 2.22% for sectional title homes. During the year to date, house price inflation for freehold homes was 5.34% - almost double the average year to date for sectional title homes (2.68%).

Semigration continues: One would expect the semigration to peripheral suburbs and holiday/retirement villages and towns to abate somewhat as people realise they may be required to go back to the office at least part of the week, making a lengthy commute less appealing or viable. However, the semigration to well-run municipalities (such as the Western Cape) is likely to continue. There is probably, however, a limit as to how long this trend can run and that is the extent to which people can afford to relocate. That said, popular areas for semigrators for lifestyle reasons include Cape Town, the Boland & Overberg, Knysna, Plettenberg Bay, St Francis Bay, Kenton on Sea, uMhlanga, Ballito and Zimbali. Gauteng, primarily Johannesburg, always attracts a high number of semigrators relocating for career and financial opportunities.

The top end of the Western Cape housing market has clearly benefitted from the two waves of semigration – particularly the second wave triggered by the pandemic. In Q2 2022, the Western Cape accounted for almost half of all >R3m sales in South Africa, followed by Gauteng at almost a third.

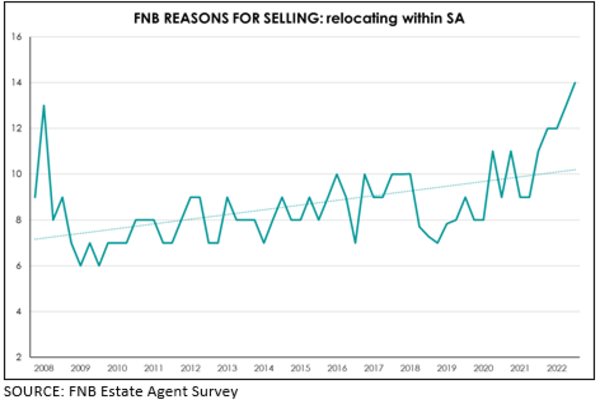

According to the Q3 FNB Estate Agent Survey, 14% of homes sold in Q3 were due to homeowners relocating within South Africa – an indicator of ongoing semigration or movement between provinces.

Urbanisation/Return of urban hubs: In addition, young people (of which we have many, although the majority cannot yet afford to enter the housing market) will continue to be attracted to the metro areas – where there are jobs and an appealing urban lifestyle. This is reflected in the large number of mixed-use developments evident in urban hubs and surplus office space being converted to residential.

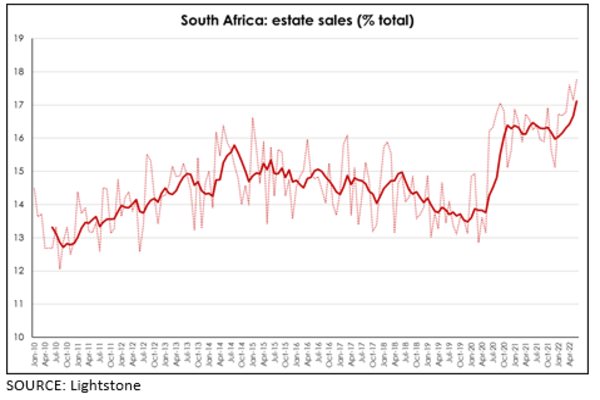

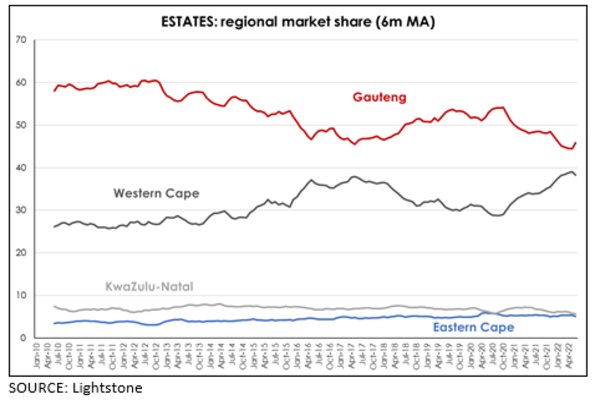

Increasing demand for estates: There is a clear increase in demand for homes in estates as a result of greater diversity in the housing offering available in estates. Apart from the key element of security, there is the added convenience of hassle-free maintenance and access to amenities which you only share with other homeowners and not the general public. Also appealing is the extent to which some estates offer self-sufficiency in water, services like waste removal and energy. According to Lightstone, just over 17% of all homes sold during the first half of the 2022 were located in estates. Estates are a small, but growing, percentage of the market – a trend we believe is set to continue. Within this market, the key beneficiary is the Western Cape – with a growing share of the market which correlates with the waves of semigration to the province.

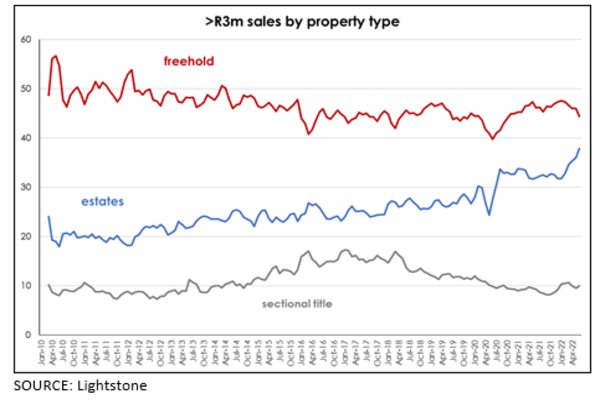

Estates account for a growing percentage of >R3m sales – rising from around 20% in early-2010 to 37.9% in Q2 2022. Freehold homes remain the most popular – and appear to have experienced a bounce during the Covid years. Sectional title homes account for just 10% of home sales in the >R3m price band.

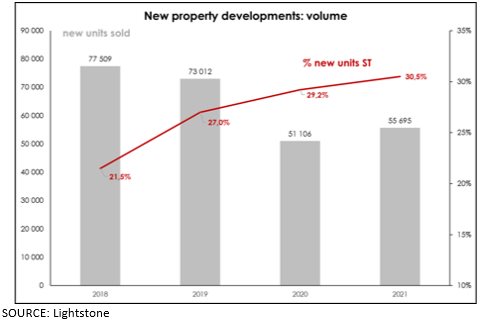

Shift towards Sectional Title: While SA housing stock remains predominantly freehold, there is a clear shift towards sectional title. This is evident in the composition of new housing stock, with sectional title increasing from 21.5% of all new homes sold in 2018 to 30.5% of new units sold in 2021.

According to Lightstone data, the two semigration waves have resulted not only in an increase in the Western Cape’s share of estate sales but also an increase in the Western Cape’s share of new home sales. Pre-Covid the Western Cape accounted for around 25% of all new homes sold in South Africa. By Q2 2022 this had risen to around one third.

There are a number of reasons for the popularity of sectional title homes:

- Affordability - particularly since there are a large number of young adults in SA looking to gain a foothold on the property ladder.

- Cost and convenience - maintaining a sectional title property is more affordable and convenient as the costs are shared with other homeowners, and services such as painting and gardening are undertaken on behalf of all homeowners.

- Amenities - while estates offer homeowners various amenities, new developments increasingly offer access to roof-gardens, pools and gyms to a larger number of homeowners and renters as part of the live-work-play trend.

- Security - security is an increasingly important issue for homeowners and is generally better in a sectional title home.

- Location - is varied but new sectional title developments tend to be focused in business nodes such as Sandton and Cape Town CBD (where land is scarce and expensive) and in coastal areas such as the Atlantic Seaboard and Western Seaboard (again, land is limited and expensive), but also increasingly in estates as the latter tries to make estate living available to a broader range of homeowners. Furthermore, the student market is increasingly important, and properties catering for this market also tend to be sectional title for the reasons above.

The rise of the 15-minute location: This seems really to just be a variation of the live-work-play type trend where everything is close at hand. So mixed-use developments will remain popular as well as key hubs or nodes with all amenities/entertainment/work on hand for those who work from home or at shared work spaces. The 15-minutes city has been around globally for a while but certainly seems to be gaining traction here, for example, central Sandton is positioning itself as a 15-minutes city.

Living with – or without – load shedding:

There are three potential ways to respond to the prospect of ongoing loadshedding in particular and failing municipal services in general:

1 – Invest in solar panels, batteries, water tanks etc and make your home as self-sufficient as possible.

2 – Relocate to an estate or development which offers greater efficiency (new mixed-use developments often include the latest technology) or to an estate which is self-sufficient in electricity, water or municipal services like refuse removal and security.

3 – Relocate to areas like the Western Cape which are better run and offer a measure of protection against load shedding – as well as offering a clear plan of how to end loadshedding in the future for example, Stellenbosch.

Uptick in vacant land sales: Over the past year we have seen an increased demand for vacant land which, could at least partially, reflect the semigration trend to areas like George, for example. Given that the movement is primarily from Gauteng (which has a well-established estate / security, gated estate sector) to the coastal regions which has a small but growing estate housing sector, much of the demand for vacant plots is within estates – so people are having to build their own homes in estates because they don’t currently exist.

It could also be the result of people moving from metro areas to smaller towns – where the housing stock is more geared for retirees, holiday homes and the like, rather than people who are now moving there permanently with their families and who are used to a certain way of living – and wish to recreate it in that smaller town. Two notable elements are:

- How affordable homes are in these towns.

- How active sales have been in many surprising places.

The Eastern Cape towns and the Gauteng South and East come to mind in particular.

Finally, the increase in vacant land sales could also reflect the fact that it is cheaper and more efficient to build a new green home than to retrofit an old home to be energy and/or water efficient. A truly green home requires specific architectural design to make it sustainable and energy efficient, making building a new home more appealing.

What of the rental market?

One of the key characteristics of the SA housing market is the young age profile of the population, which means there is a steady influx of young adults needing a place to stay. For those who can afford to leave home, most traditionally start by renting. One of the unexpected benefits of the pandemic was that the aggressive interest rate cuts implemented in the early stage of 2020 suddenly made homeownership more accessible to a large percentage of young adults and we saw a surge in FTHB during the early stages of Covid. This trend obviously was limited by high unemployment rates.

Nonetheless, the rental market was hit, particularly as the travel bans meant that the bulk of short-term rental properties were shifted into the long-term rental pool, further weighing on rentals.

That ultimately shifted back to pre-Covid patterns, particularly as interest rates have been hiked rapidly and the economy remains weak, compelling most potential FTHBs back into the rental market. The resumption of tourism and business travel – and the prospect of a bumper summer season – has seen the rental economy begin to recover as demand for short-term rentals improves.

There has been a marked increase in applications for investment or buy-to-rent properties in recent months, according to ooba. This suggests that buyers see the residential property market as an attractive investment proposition, and could also include those who ultimately intend to semigrate elsewhere in the country, opting to gain a foothold in their desired town or metro housing market with an investment or rental property until such time as they are ready to relocate.

Shared living:

Affordability is prompting many people to live together. It has long been a South African trend – families share homes (voluntarily but in some cases due to financial circumstances) but also students sharing accommodation. More recently there has been an increase in the number of young professionals buying homes together – sometimes not as partners but just as friends. For young adults the options seem to be - in the case of affordability constraints but also because of the desire for company - to buy a micro apartment in a development with shared spaces and an inhouse community, or to club together with friends and purchase a home.

Offshore investment:

Over the past year we have found that the most popular investment destinations are Mauritius and Portugal, although we have recently seen an uptick in interest in UK property, such as the recently released Brent Cross Town development with 6 700 new homes with parks, open play grounds and retail only 12 minutes by tube to Kings Cross in the heart of London.

For most people, EU Citizenship remains the ultimate goal, while hedging their ZAR portfolio in hard currency real estate, and diversifying their portfolios, coupled with a long-term, retirement plan. Most favoured in Portugal are the bespoke hospitality developments offering Golden Visa opportunities from €280 000. Early next year we will be launching both the Greece Golden Visa programme and the Spanish Golden Visa programme.

Global mobility has increased and so permanent residency has been elevated as an important reason to purchase offshore. Generally, South Africans tend to invest between USD375 000 and USD5 million. Mont Choisy Golf & Beach Estate in Mauritius remains in demand among SA buyers, who like the estate feel and facilities, as well as the proximity to Grand Baie. In Seychelles, lifestyle is a big factor for buyers on Eden Island, with incredible sailing, fishing, snorkelling and diving with some of the best conditions in the world. Some buyers opt for the Residency which is available for anyone to apply for as long as you own a home in Seychelles.