First-time homebuyers in the Western Cape, KwaZulu-Natal, Free State and the north-western parts of Johannesburg, get better value for their money than buyers elsewhere in South Africa.

Provincial outlook

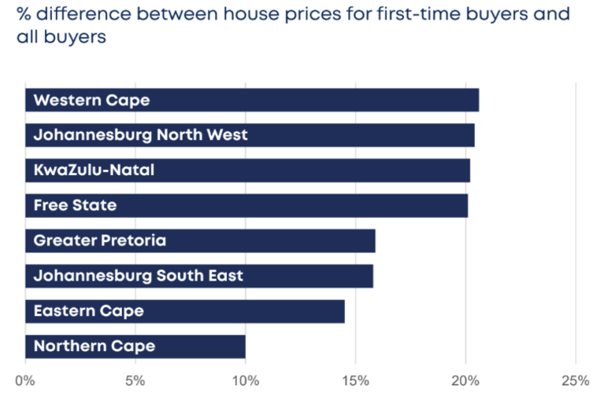

In the launch issue of the BetterBond Property Brief (March 2023), research economist Dr Roelof Botha writes, “In provinces with greater population density and therefore more housing stock, first-time buyers often get better deals.” The table below compares the difference in house prices for all buyers with those for first-time buyers, showing that first-time buyers in four provinces get 20% or more home value for their loan. In Greater Pretoria and the south-eastern parts of Johannesburg, it is almost 15% more than other buyers, while in the Northern Cape the price difference is around 10%.

Source: BetterBond Property Brief

Source: BetterBond Property Brief

The national average price of a home for first-time buyers, based on BetterBond home loan applications for the 12 months ending March 2023, is R1.2 million, says Carl Coetzee, CEO of BetterBond.

“First-time buyers in the Western Cape pay more for their homes than buyers elsewhere in the country, but in terms of price difference between these and other buyers, they are getting more bang for their buck. This helps us understand why premiums are being paid in some parts of the country.”

BetterBond data for March 2023 puts the average first-time home purchase price in the Western Cape at R1.5 million. A quick search on Property24 shows that R1.45 million will buy a one-bedroom apartment in the Gardens area of the Cape Town CBD, or a two-bedroom apartment in Claremont in the southern suburbs.

In the north-western parts of Johannesburg, the average first-home purchase price is R1.2 million. This would secure a two-bedroom apartment in Linden or Northriding.

In KZN, the average price for a first home is R1.19 million. “KZN offers first-time buyers’ considerable value for money, with more than 20% difference between house prices for first-time buyers and other buyers,” says Coetzee. In areas such as Morningside, Glenwood and Reservoir Hills, aspirant buyers stand a good chance of finding properties priced below R1.2 million.

“The government's decision to increase the transfer duty threshold to R1.1 million could kick-start many first-time buyers’ homeownership plans,” says Coetzee. “This threshold exempts buyers from paying transfer duties on properties that sell for R1.1 million or less.”

First-time buyers may also qualify for bonds in excess of 100% if they meet the banks’ lending criteria. March 2023 data released by Lightstone shows that 59% of residential homes registered at the Deeds Office are owned by first-time buyers.

“There are still plenty of opportunities for first-time buyers to enter the property market,” says Coetzee, “and as we can see, there is significant value for money to be had if you choose your location carefully.”

Writer: Dominique Wingrove