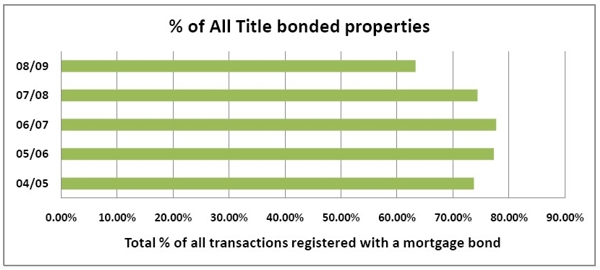

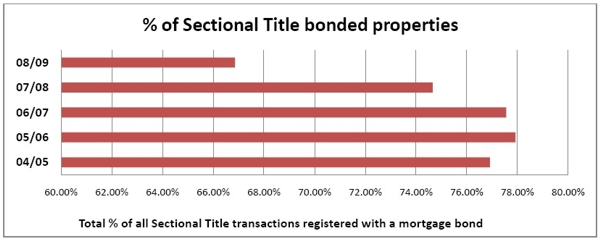

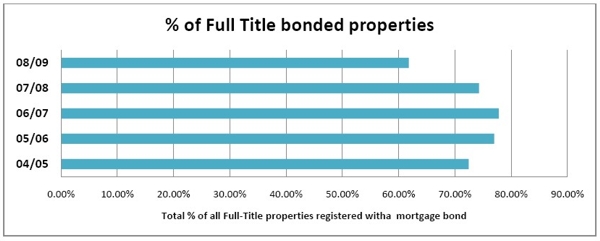

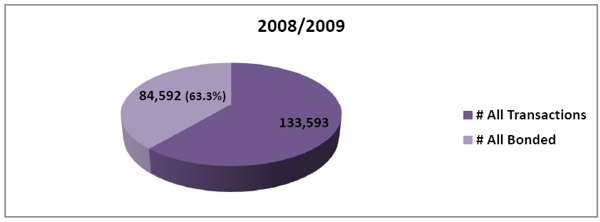

While the NCA was fashioned to prevent reckless lending, as a nation we have not, as yet, created a savings culture to diminish our reliance on financial institutions. Though, a surprising level of liquidity amongst current buyers in the real-estate economy, (about 36.7% of properties purchased in the past year) might prove that we are on the right track. Dieter Deppisch, the head of Property Data Research & Training at SAPTG (South African Property Transfer Guide) discusses how the NCA has affected buying patterns and the trends seen in the real-estate industry at the moment. “The name’s Bond, Mortgage Bond”Tito Mboweni is the first South African Reserve Bank governor to have become a true celebrity! Everywhere he appears in public, groupies hang onto his lips, frantic to know whether there will be another rate-cut or not. The groupies however, are atypical. Not lingerie-throwing, screaming teenagers but normal homeowners paying off their prime-rate linked mortgage bonds. Never before has mortgage bond finance provided so much fodder for dinner party conversations. Leading insights and analytics company, Knowledge Factory, in conjunction with their property data division SAPTG, have just released a study of mortgage bonds and trends in South Africa. Their findings make for interesting reading. The research focused on transactions in the period June 2008 to May 2009. The study included residential full and sectional title properties in the price band R200 000 to R20 million. Dieter Deppisch, who heads Knowledge Factory’s property data research, explains: “The pre-June 2007 days of a relaxed lending environment were distinguished by largesse. Home buyers, bond originators and banks were happy bed-fellows. Then the National Credit Act (NCA) created a perception of gloom, causing widespread fear and a contraction in credit extension. Worse, the winds of the worldwide recession made landfall shortly afterwards and South Africa’s economy began to deteriorate rapidly. Interest rates followed the upward spike in inflation; banks sat with toxic assets, and quickly tightened their lending criteria to stem the blood-flow.” In the period 2004-2007, bonded property transactions were de rigueur. They reached a peak in the period June 2006-May 2007 with 77.7% of all properties being registered with a bond. Of these, the largest group (78.5%) were sectional titles purchased in the R200k-R1,5mill price band, with full-titles coming in a close second (78,2%). However, the decline in bonds being registered began shortly thereafter and has continued unabated to current levels where only 63.3% of properties were registered with a bond in the 2008/2009 period. The flipside of the statistics above indicates a surprising level of liquidity amongst current buyers in the real-estate economy. 36.7% of properties purchased in the past year were cash deals (properties transferred with no bond registered). This statistic must however, be qualified: Full-title property sales dropped by 40% and sectional title by 44% in the period June 2008 to May 2009. So while the percentage of cash sales is high, it is of a smaller volume of transactions than we had a few years ago when real-estate was booming. Property is an increasingly attractive asset class for investors disappointed by recent poor returns in the equity market and other investment classes and this has served to boost cash sales.

Loan to Value Ratios (LTV) The study showed the significant change in LTV’s, given the numerous drivers we find in a recessionary economy. Whereas the period 2005/2006 saw full-title properties bonded at a LTV ratio of 103.6% this dropped to 95,2% in the period 2008/2009. Deppisch elaborates: “The decline in LTV’s can be directly attributed to demands for higher deposits and reduced risk appetite on the part of financial institutions. Vacant land transactions were particularly unattractive and seldom achieved anything higher than a 70% LTV ratio. Interestingly, sectional title bonds currently have a lower LTV rate than full-title, namely 90,8%.” In general financial institutions have been more cautious with credit extension for sectional title. While this property type offers the buyer many benefits and is a favourite of buy-to-let investors, part of the perceived risk involves body corporate financial management. The management (or lack thereof) of the complex can seriously impact on the long-term asset growth of the individual sectional title. Coastal versus Inland An interesting comparison was made between inland and coastal properties (within 500m of the sea). While 64% of inland properties are mortgaged, this drops to just 47% for coastal properties. Deppisch provides some insights: “Traditionally there has been a lesser need for finance for coastal property sales. Many are bought by folks who sell their mortgage-free inland homes to retire at the coast and are able to finance the deal themselves without further debt being incurred. Some purchases are smaller homes in retirement villages, where lifestyle changes and the need for security and low-maintenance are the drivers. Others are vacation homes bought with a windfall or insurance/pension payouts. Even in the seller’s market 4 years ago, when over 78% of inland homes were being financed, less than 64% of coastal deals required mortgage involvement. Coastal transactions account for merely 4.2% of all transactions. Yet, while the volume might be low, their popularity remains high. This is borne out by the fact that coastal property registrations have only declined by 21% y/y in comparison to the 39.6% y/y decline in inland transactions.” Highest Rate by MetropolThe various metropolitan areas of Gauteng, Cape Peninsula, Garden Route, Durban and Eastern Cape recorded differing levels of reliance on mortgage bond assistance. However a definite trend is visible: The need for property finance is split by the socio-economic divide. Cape Town: Poorer areas such as Mitchells Plain, Khayelitsha and Blue Downs recorded the highest rate of bonded properties namely, between 87-92%, while affluent areas in Strand and Constantia recorded the least with 51.6% and 49.4% of properties requiring financial assistance, respectively. Gauteng: Willowbrook, Protea Glen (part of Soweto) recorded rates of over 90% while the sectional title sales in Honeypark set the national record by having the highest mortgage rate in the country over the past 12 months, namely 98.6%. Whereas Morningside (northern suburbs) and Moreleta Park (Pretoria) had the least need for bonds with just 63.9% and 67.9% respectively. Durban: More than 86% of Sea View, (R500k-R600k range), and the sectional titles sold in the Sherwood area registered a bond at the time of the transaction. Amongst the more prosperous suburbs the areas that revealed the lowest bond rate were La Lucia and Umhlanga Rocks with just 59.1% and 46.5% respectively. Eastern Cape: Here the trend continues with underprivileged areas like Motherwell (88.3%) and Kwadwesi (94.3%) showing high reliance on financial assistance while far fewer of the privileged buyers of properties in Jeffreys Bay (52.1%) required the same. Even less, a mere 47.6% of Walmer (Port Elizabeth) buyers supported their bank’s home-loan divisions. Garden Route: This part of the country has been referred to as South Africa’s retirement village. Thousands of retirees and other affluent buyers flock to the Garden Route each year to enjoy its coastal beauty and relatively crime-free tranquility. In line with national trends for coastal regions, real-estate transactions there recorded the least reliance on home-loans in the country. Only the more densely populated urban areas of George and Mossel Bay recorded over 50% of bonded transactions. The towns of Knysna, Sedgefield, Wilderness, Reebok and Grootbrakrivier on the other hand, have some of the lowest rate of bonded properties in the recent cycle, hovering at between just 33-41%. The areas with the lowest rate in the entire country are also found in the Garden Route. SA’s version of Monaco, the well-heeled seaside town of Plettenberg Bay (28.7%) and the picturesque hamlet of Hoekwil (21.1%) nestling in the shadow of the Outeniqua mountains near George. Bond versus Purchase PriceA correlation is clearly seen in the bond size versus the purchase price when digging into the various price bands. Lower priced purchases have a greater reliance on bond finance. Bonds in excess of 100% were excluded in this analysis as they often include bonds required for building on vacant land. In the price band R100k-R600k the bonds averaged 66% of the purchase price, in the band R600k-R1,5mill it was 52% dropping still lower to 46% for the band R1,5mill and higher OutlookWith South Africa’s economy in slow-recovery mode, extensive rate-cuts and a cautious increase in lending institutions risk appetite, real-estate sales are expected to rise. Recent data indicates a slowing in house price deflation with the hoped for inflation in this sector said to return during 2010. This sanguinity is underscored by home-loan divisions reporting a decline in mortgage loan arrears which points to an improved ability of clients to service debt. Above these positive trends hangs a cloud – that many South Africans will again allow themselves to become heavily indebted. While the NCA was fashioned to prevent that from happening, as a nation we have not, as yet, created a savings culture to diminish our reliance on financial institutions. And, until we do, we will continue to be Reserve Bank Governor groupies.