There is a clear flight of property wealth to the Western Cape, but Samuel Seeff, chairman of the Seeff Property Group says, it is potentially also going offshore. Even in the Cape, the wealthy are spending less than what they could with the rest then potentially invested offshore.

What is currently happening?

What is happening at the top end of the property market, he says, has always been a reliable initial indicator for investment in the country. It is the “canary in the coal mine” so to speak.

“We see clearly, that despite two exceptionally good property years - and a record number of sales above R20 million in the Cape especially last year – we can clearly see that the upper price limits are now growing and it has stagnated in the Sandton/Johannesburg area”.

Confidence is worryingly low, and the wealthy are clearly “voting with their wallets” showing that the wealthy are not confident about their investments. There is growing concern about where the country is heading.

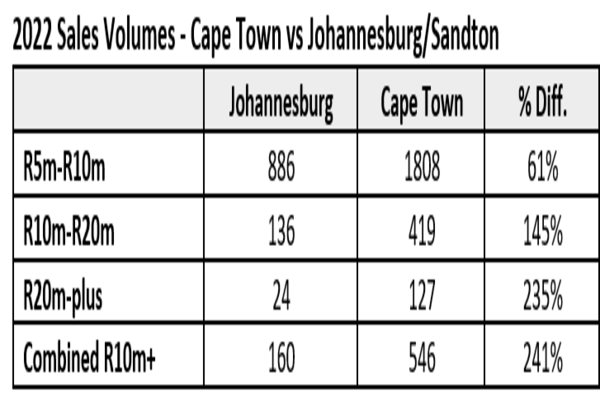

Nowhere is this better demonstrated than when you compare Cape Town and the Johannesburg/Sandton area. There has basically been slow movement above the R10 million price band for the last 10 years and upper price limits are not moving at all.

Even in the Cape, Seeff adds that despite the record number of sales above R20 million in the 2022-year across the Cape Town Metro last year, upper price limits have remained more or less the same as it was five years ago.

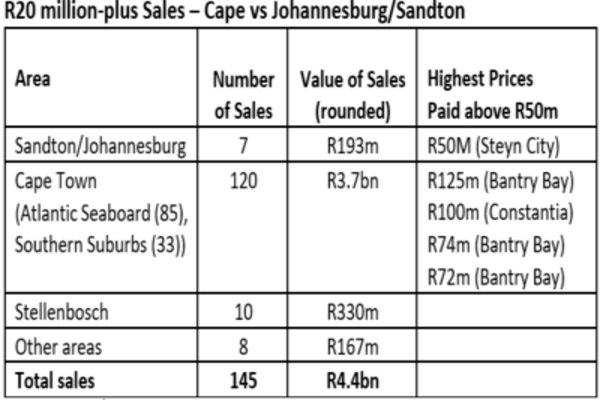

It is notable that more properties sold above R20 million in Stellenbosch (10 sales with a combined value of about R330.6 million) over the last year compared to Sandton/Johannesburg where just 7 sales worth under R194 million were recorded.

“The upper end sales in the Johannesburg/Sandton areas were also mostly in the lower R20 million range with only a single high value sale of R50 million (in Steyn City). The highest price achieved in Sandhurst, reached only R30 million, well below what we should expect for what is one of the two top suburbs on the continent”.

In Cape Town too, sales are mostly in the lower R20 million range despite a record 120 properties worth a combined R3.7 billion sold above the R20 million last year. Only just over a handful of sales were above R50 million and the top end price ceiling has hardly moved since around 2015.

“Despite the buoyant investment last year by international buyers - about 30% of all sales were on the Atlantic Seaboard as they still see good value. International buyers too may become reluctant to invest locally”, says Seeff.

Source: Seeff/Lightstone

Source: Seeff/Lightstone

There also appears to be no sales above R50 million in Clifton or at the Waterfront last year which is concerning given that it was a record year for this sector and these are absolutely prime locations.

Source: Seeff/Lightstone

Source: Seeff/Lightstone

Even just looking at the R10 million-plus level tells the story of 241% more sales in Cape Town compared to the Johannesburg and Sandton areas with 546 sales compared to just 160. This clearly shows how much more the wealthy will invest in Cape Town and the reason is well understood; better service delivery and confidence in the local governance.

A strong property market supported by wealthy buyers is the cornerstone of a strong economy. Real estate contributes about 6% of the total GDP and supports just over 3 jobs (direct and indirect) for every R1 million generated. Seeff says it is an excellent early warning indicator that the country now needs to see strong leadership driven by a Cabinet fit for purpose and a sense of urgency to set the economy back on a growth-led path.

Writer : Gina Meintjes