Too many people invest their hard-earned money without any consideration of tax. Every investment has a tax implication and tax can seriously alter the realised return on investment. Paying less tax to the South African Revenue Service (SARS) means more of your investment returns make it to your pocket. Many people are completely unaware of the tax advantages of property investment. Property investing provides both income tax and capital gains tax (CGT) advantages.

Capital gains tax advantages

Capital gains refers to profit earned from selling an asset at a higher price than the purchase price. In general, capital gains are taxed at a lower effective rate than income tax or dividend tax. The maximum effective capital gains tax rate for individuals in South Africa is 18%. Real estate provides even more capital gains tax advantages.

If you invest R100 000 in the stock market and grow it to R1.5 million, the taxable capital gain would be R1.4m (R1.5m-R100k).

Assume you instead buy a R1 000 000 investment property with a 10% deposit of R100 000. When the property value increases to R1 500 000, your capital gain would only be R500 000 (R1.5m-R1m). Even though you have grown your R100 000 investment 15x, only R500 000 of that is taxable as a capital gain.

The key here is that SARS takes the purchase price of the asset as a starting point and not your original investment capital. Something else to think about here is you only needed the property value to increase by 50% by the time the loan is paid off to make 15x your money.

But that is not all. Property investment qualifies for even further tax benefits. SARS says investors may capitalize transaction costs such as the initial transfer fees, as well as renovation costs and marketing expenses. These costs are added to the R1 000 000 purchase price to form what is known as a base cost when calculating capital gains.

The following costs can be added to the base cost for the purpose of calculating capital gains tax:

Cost of effecting an improvement to or enhancement of the value of the asset

The remuneration of a surveyor, valuer, auctioneer, accountant, broker, agent, consultant or legal advisor, for services rendered

Transfer costs

Securities transfer tax, transfer duty or similar tax or duty

Advertising costs to find a seller or to find a buyer

Moving costs

Installation costs including foundations and supporting structures

Donations tax limited by a formula

Cost of an option used to acquire or dispose of the asset

Source: SARS

Example:

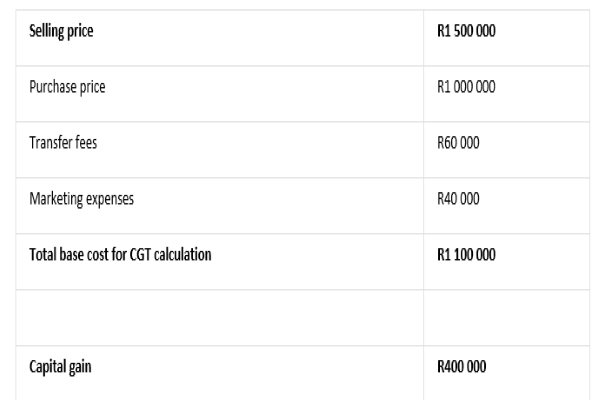

Assume you spent R60 000 on transfer fees to buy the property and R40 000 to market and sell the property, your capital gain calculation would look as follows:

If the property is your primary residence, you will not pay any tax at all in this example. SARS allows all South Africans a R2 million CGT exemption on the sale of a primary residence.

Income tax advantages

Property investors who own property in their personal name should know that all income from investment property is included in your overall taxable income and is taxable at your marginal tax rate. At first glance, this may appear to be a big disadvantage of property investment, especially for high income earners. However, SARS views investment property as a business. This principle means all costs incurred to produce revenue may be deducted for tax purposes. Interest expenses on financing are an example of deductible expenses and will likely be the largest tax deduction in the early years.

Examples of deductible expenses for income tax:

Interest expense on home loan

Municipal rates and taxes

Levies

Electricity costs

Professional services e.g. property management or legal fees

Marketing costs to find a tenant e.g. Property24 advert

Credit history screening costs

Maintenance costs

Interest expense on home loan

Municipal rates and taxes

Levies

Electricity costs

Professional services e.g. property management or legal fees

Marketing costs to find a tenant e.g. Property24 advert

Credit history screening costs

Maintenance costs

Income tax advantages are best explained with an example.

Example:

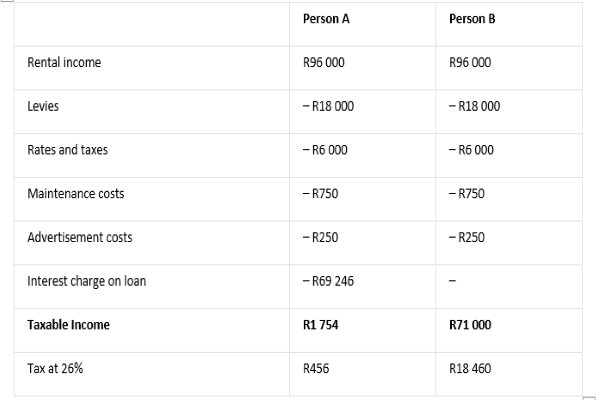

Assume two people each purchase a R1 million investment property. Person A takes out a R1 million loan and Person B buys the property for R1 million cash. Person A and Person B have a tax rate of 26%.

Additional assumptions:

Person A finances over 20 years at 7% interest

Rental: R8 000 per month

Levies: R1500 per month

Rates and taxes: R500 per month

Maintenance costs for the year: R750

Advertisement to find a tenant: R250

Year 1 tax calculation:

The table above shows Person A was able to reduce their taxable income from R71 000 to only R1 754. This is due to the interest expense on a R1m property financed at a 7% interest rate over 20 years amounting to R69 246 in year 1. Saving tax due to interest expenses is known as a ‘tax shield’.

Once again, using debt to finance property investments provides significant tax benefits. The disclaimer is that home loans are amortizing. That means the interest portion of each monthly repayment is less and less each month. Therefore the tax benefits or tax shield provided by interest expenses decrease over time as the loan is paid off.

Parting shot

Real estate is one of the most tax advantaged asset classes when debt is used to purchase properties. The biggest tax advantage is on the CGT side. Personal finance bloggers and personalities harp on about how bad debt is and I feel they miss the point of separating bad debt from good debt. When it comes to investing in real estate, debt is your friend. Using debt to purchase income producing, growing assets and leveraging returns on invested capital is clearly a good use of debt and provides many advantages.

Article credit: http://www.forinterestsake.com/tax-advantages-of-investment-property/

Writer : Kelin Pottier