Here’s what you will need to do to get yourself ready to take on the first steps of renting a home.

WHAT IS YOUR AFFORDABILITY?

First things first; you’ll need to be financially able to afford the rental payment, as it usually comes with a fixed-term rental contract, with financial consequences, if it’s not paid.

You will also need to make sure that you have enough money to cover the deposit (which is usually 1 - 2 months’ rent).

Are you creditworthy?

A Credit Score is a three-digit number which helps lenders, employers and landlords decide whether to give you credit, employ you or let property to you.

The higher the score, the better you have been managing your debt in the past, which means you can be considered ‘low risk’ and your rental application is more likely to be accepted.

!! TIP : You can access a free credit report online from these credit bureaus:

- www.experion.co.za

- www.xds.co.za

- www.compuscan.co.za

- www.transunion.co.za

Are you prepared?

To stand the best chance of securing a rental home, it’s a good idea to go to a property viewing with a few things on hand:

- A copy of your ID

- Your credit score

- A copy of your latest pay slip

- Latest 3-months' bank statement

- Enough money in your account to pay the deposit and at least the first month’s rent

HOUSE HUNTING - FINDING A PERFECT RENTAL

Things to take note of on your house hunting journeys.

Put together a comprehensive list of considerations you need to keep in mind, such as:

- Your budget – be realistic about what property you can afford.

- Your needs – Consider your present- and future needs.

- Your lifestyle – find a neighbourhood that offers your desired lifestyle. Is it run down or experiencing a lot of development? Is the property subject to a lot of noise?

- Security – how safe is the property? Is crime in the area under control?

- Proximity – to healthcare, schools, work and shops.

- Your space – the minimum number of bedrooms, bathrooms, parking bays and garden space that you need. What will it cost to secure your pets? Are your communication needs met? Consider all other initial costs of operating your household.

- Property type - do you want to live in a freestanding house, a flat or in a complex? Is the complex well run and maintained?

- Maintenance – do you have the time to maintain the garden and pool?

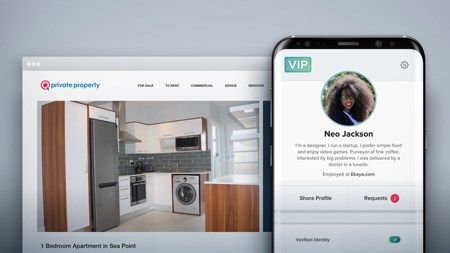

!! TIP : You can get the latest property rentals in your area sent to you by email or SMS. Set up property alerts on Private Property and be the first to know.

!! TIP : Private Property has launched SA’s first property feed. Download the app, follow the suburbs that you’re interested in and we’ll send you matching properties instantly.

HOW TO GET THE MOST OUT OF YOUR PROPERTY VIEWING

Research the property online first - Use Private Property to find out as much as you can about the property. Property websites have useful resources like photographs and property trend info for you to use.

Arrange a viewing - Once you’ve found a property that appeals to you, contact the relevant agent or landlord to arrange a viewing.

Try to arrive early for a viewing so that you have time to explore the neighbourhood, chat to locals and identify any potential issues.

!! TIP : Private Property’s Neighbourhoods allows you to explore the lifestyle of different areas through video, images and content.

!! TIP : Take a camera and tape measure with you. The camera will help you to remember details about the property later and the tape measure will allow you to judge whether your furniture will fit.

BEWARE OF RENTAL SCAMS

How does a rental scam work?

- Fraudsters will place a bogus advert for a rental property with photographs, a ‘ready-to-sign’ fake contract, and a false name and contact details.

- They will do anything to avoid showing you the property in person. The fraudster will ask you pay them the deposit (and sometimes the first month’s rent) into their account.

- They will promise that on receiving the deposit they will contact you, to make arrangements to deliver the keys to the property.

- However, upon receiving your deposit the fraudster will make a swift disappearance and become unreachable.

How can you avoid scams?

- Trust your gut! If you do not feel that the offer is legitimate or it sounds “too good to be true” or you feel like the person you are dealing with is trying to withhold important information, chances are that you are correct.

- Investigate and try to obtain as much information as you can about the property. Speak to current tenants, neighbours and whoever you can and ask them about the owner and the property.

- Ask to be provided with the utilities account of the property. This will provide proof of the identity of the registered owner.

- Have an attorney look over your lease agreement and make sure that it is in fact a legitimate legal document.

- If you are viewing the property, but you feel like there is something ‘fishy’ going on, always take somebody you trust with you as a safety measure and a witness.

- Take down as much information as you can, about the

property and the people you are meeting with. Try and get a

vehicle registration number or a photo of the property which

includes the person showing the property to you:

- If it’s an agent: make sure that they work for a reputable estate agency. Find out from the agent their full name, surname, ID number and which branch they work for. Then confirm this with the company.

- If it’s the landlord: make sure that you receive their full name, surname and ID number, which you can confirm through your local

authority.

Now that you have your ducks in a row...

The next step in your Renting 101 Guide is "Signing on the dotted line":

- Getting your ducks in a row

- Signing on the dotted line

- How to deal with the deposit

- The landlord-tenant relationship

- Terminating a lease agreement