Following a season of unprecedented activity, the South African property market seems to have entered a cooling off period, largely owing to the steep incline of interest rates.

According to Lightstone Property data, as at 11 April 2023, a total of 31,632 bond registrations were recorded at the Deeds Office for the period January to March 2023. The RE/MAX National Housing Reports reveal that this figure is down by 14% on Q1 2022’s figures.

The same data also reflects that the number of transfers (both bonded and unbonded) recorded over the same period amounted to 47,707*. When reviewed against the figures from previous RE/MAX National Housing Reports, this amount is down by 16% on last quarter and by 9% YoY.

Of the 47,707 transfers, a total of 23,996* freehold properties and 13,183* sectional title units were sold countrywide (these figures exclude estates, farms, and land only transfers). Reviewed against previous RE/MAX National Housing Reports, the number of freehold properties registered dropped by 8% YoY and sectional titles dropped by 4% YoY.

“Within the RE/MAX network, the number of units sold in Q1 2023 is also down 18% on last year; which, considering that we had record-breaking years in 2021 and 2022, is not as bad as it could be. But, it does point to a tightening of market activity. Our Reported Sales totals are also lower this quarter, which is a fair indication that buyers are not as active as they once were,” says Adrian Goslett, Regional Director and CEO of RE/MAX of Southern Africa.

“While traffic to our website remained much the same as last quarter, the number of buyer enquiries is down 30% YoY while the total number of listings on our website has increased by 62%. This points to a lot more homeowners looking to sell and fewer buyers looking to purchase,” he comments.

Highs and lows for house prices

Lightstone Property reported in the House Price Index as of February 2023 that national house price inflation is at 2.31%, having decreased consistently since early 2021. According to the report: “Annual property inflation remained steady in KwaZulu-Natal and the North West, increased in Limpopo and Mpumalanga, and decreased in the Eastern Cape, Free State, Gauteng, the Northern and Western Cape.”

In addition to this, according to the Lightstone Property data retrieved on 11 April 2023, the nationwide average price of sectional titles is R1,115,509. When reviewed against the figures from previous RE/MAX National Housing Reports, this amount is 10% higher YoY. The nationwide average price of freehold homes is R1,331,685 which, when reviewed against the figures from previous RE/MAX National Housing Reports, is 1% down YoY.

The average active RE/MAX listing price for Q1 2023 saw an incredible amount of growth, increasing to R4,768,265 (↑ 45% YoY). “As the largest real estate brand in Southern Africa, our website hosts listings at all price points, from the affordable markets to the high-end luxury listings. It is possible that we have seen more high-end properties come to market this quarter, which might account for our average listing price increasing over this period,” Goslett explains.

Western Cape still highly sought-after

The Western Cape was once again the most searched province on remax.co.za during Q1 2023, claiming the top five search positions:

Claremont

Parklands

Rondebosch

Sea Point

Sunningdale

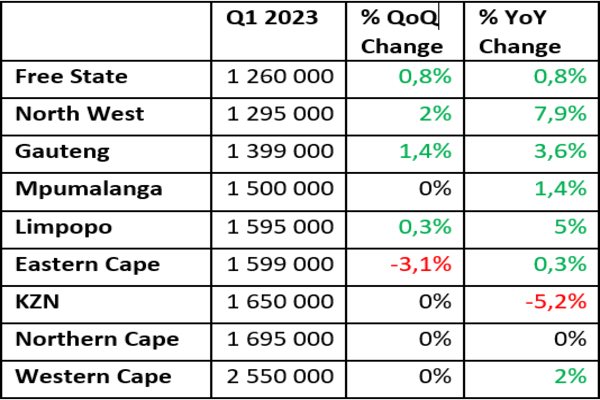

The Western Cape also continues to be the most expensive province. According to Private Property, the median asking price per province of active listed stock on Private Property for Q1 2023 were as follows:

* Disclaimer: The data reflected herein represents data that is voluntarily obtained from subscribers from the Private Property South Africa’s website and is based solely on data collected by Private Property South Africa (Pty) Ltd. Further, the data reflected herein is accurate as per the Private Property South Africa database dated 12 April 2023. Reliance on such data is at the sole discretion of subscribers and Private Property South Africa hereby indemnifies itself of any consequence of such reliance.*

Final thoughts

“While market conditions are still fair at present, I do foresee things tightening further. The temporary shutdown of the Pretoria Deeds Office – the largest in the country – will mean a backlog of transactions and cause setbacks for the property market as a whole. The effects of the latest interest rate hike are also going to be fully felt in the months to follow. This might lead to more homes entering the market and fewer qualified buyers who can afford to purchase property over the months to come,” says Goslett.

“However, the need to buy, sell, and rent property will continue to exist within all market conditions. Attracting the right buyer or tenant will come down to marketing the home at fair market value and partnering with a reliable real estate professional who will help match your home to the suitable buyer,” Goslett concludes.

Writer: Kayla Ferguson