Learn more about the renovation and holding costs involved with flipping a buy-to-sell property. The key with renovating a property here is to make sure you renovate the property not to your liking but to the standard and liking of that of your buyer.

UNDERSTANDING REFURBISHMENT COSTS

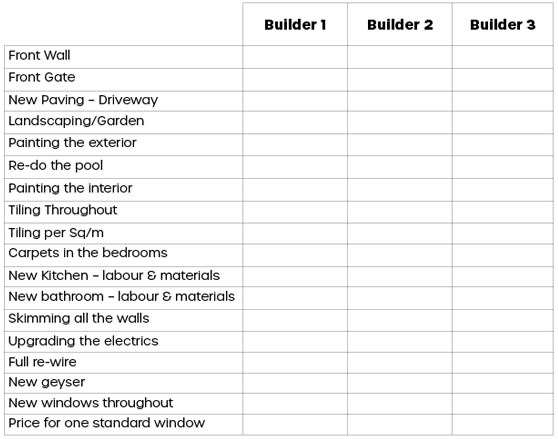

Once you have found a distressed property you could design a basic spreadsheet in order to compare the quotes that you obtain.

This simple, yet useful spreadsheet, will be your golden ticket to understanding exactly what things cost. As shown in the example, the left-hand column states most of the things that are required when refurbishing a house.

You must check things like; the front wall and gate, the landscaping, pool, etc. These things are critical to the sale of the house.

The remaining 3 columns are for the builders to fill in. They will provide you with quotes regarding how much they think each specific job will cost. Usually each builder will give a different price range given the type of materials they use and their hourly rate.

In order to get the best quote comparison, ask them all to give an estimate for bog standard materials and to provide their hourly rate to you separately. This will give you a clear indication of what the materials cost and what the average hourly rate of a handyman is.

The quotes might vary, but that is ok. You are not trying to get a perfect estimate, but rather a rough “guesstimate”.

You should also give the 3 builders the same spec, so don’t let the builder just walk in and tell you what you should and shouldn’t do. You need to know what your outcome is and therefore, you say to the builder “Please quote according to this spec”. However, be clear that when the builder inspects the property and they do spot something that you missed, they should bring this to your attention and add it into the quote.

Another great thing about having this excel sheet is that it acts like a checklist for you to remember everything that you need to look out for. Get some advice from the local estate agents on what the specs should look like.

The key with renovating a property here is to make sure you renovate the property not to your liking but to the standard and liking of that of your buyer.

For example, if you are renovating a 1 bedroom flat in an area where flats are being sold for R 300 000, do you really need to be putting in gold taps? Absolutely not! Just because you may have gold taps in your property, doesn’t mean the market you are selling to wants gold taps or will buy faster or at a higher price.

!! Tip : View some properties that are in the same bracket

as the one you want to flip and do a comparison.

UNDERSTANDING HOLDING COSTS

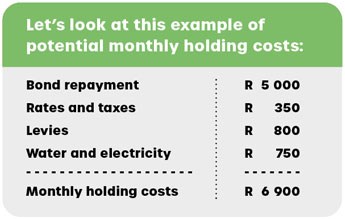

Holding costs are running costs whilst you renovate the property. So let’s say you are renovating a property in a complex. Once you take transfer you will be liable for various costs such as rates and taxes, levies, bond payments and utilities.

Let’s look at this example of potential monthly holding costs:

If you think that it’s going to take 8 months to get the property off your

hands, you then need to budget for R 55 200 whilst you hold the property.

Now that you know about running the numbers...

and you understand the renovation and holding costs...

The next step in your Buy-to-Sell Investor Guide is "Know the market value of the renovated property":

- Run your numbers and buy right

- Understand the renovation and holding costs

- Know the market value of the renovated property