The outlook for the residential property market remains subdued, with real house price deflation predicted for 2013. But, weak house prices are ironically good for the buy-to-let market, as yields are gradually improving.

According to a recent FNB/TPN report, average gross initial yields grew from 6.6% in 2006 to 8.5% today. Rode deducts 1.5% to arrive at a net yield. A 7% net yield will not attract investors into the market, as it is below the cost of finance. This is evidenced by only 7% of purchases being for buy-to-let, compared to 25% a few years ago.

But, for us at YDL, it has never been about the averages. The market is not one big amorphous mass. Rather, it is made up of many niche markets, ripe with opportunity for beating the averages.

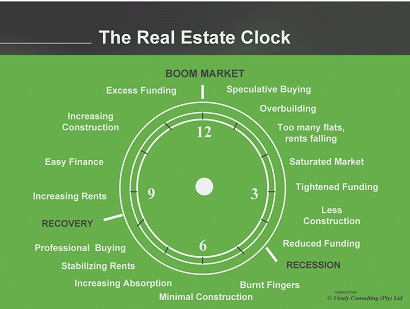

One of our 8 golden rules is to become a niche expert. This could be anything – distressed properties, student accommodation, retirement villages, fixer-uppers – as long as you become the expert. This is done by tramping the streets, and getting your hands dirty. This is the time for professional buyers – who are niche experts – setting themselves up for great future wealth.

And, don’t forget the basics. Property is a conservative, long term, steady, income investment. It is not about quick gains. Prime among the simple, age-old rules of property success is that income is far more important than capital growth. Concentrating on rental income rather than capital growth is not as dramatic as chasing capital growth but its compounding is what Albert Einstein is alleged to have called the “8th wonder of the world”. Anyone who has been receiving rental income from a property for more than 10 years will know exactly what we mean.

But, there are challenges, particularly access to finance. Here are some thoughts on what can you do to give yourself the best chance of getting finance, doing great deals, and holding on to them:

Save, save, save. The greater your deposit, the better your chance of raising a bond.

Your credit record is your “financial DNA”. Protect it at all costs. Pro-actively talk to your bank when you feel financially squeezed.

Be creative – if you can’t raise the full bond on your own, do deals with others. It is better to have part of a good deal than no deal at all.

Do cash flow “what if’s” before you buy – for example, if interest rates increase by a few percentage points, will you still be able to manage your property’s cash flow?

As your portfolio grows, build good, trusted, support teams consisting of lawyers, accountants, property managers and handymen, and so forth.

Do regular maintenance to preserve your assets.

Start considering and thinking “green”. As tenant living expenses rise (especially for costs such as electricity where increases will be above inflation), your rent will come under increasing pressure. Investigate alternatives such as heat pumps, solar heating and the like.

Prevention is better than cure. Rigorously screen your tenants before placing them. Consider rental insurance as a back-up, although it comes at a cost, and cash flow might be more important for you.

If tenants do default, act immediately to minimise potential losses.