We know that when property prices bubble it’s not good.

A bubble, defined as a “trade in products or assets with inflated values” is really hard to predict and as most of you experienced over the last 2 years, is only evident when prices of houses deflate fast and we realise that the air escapes between the traded price of the house and the real price that a willing buyer will pay for it when the air of speculation escapes and value finds a new base.

It would be really cool to have an indicator that jumps up and punches us in the nose when we want to buy a property at a time when spin is driving up house prices, not fundamentals, but as history proves it would have to knock us out to keep us sensible. Investors follow the crowd, and when prices move strongly, investors dive in.

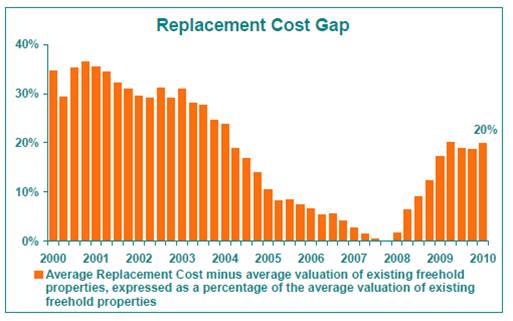

A wise economist once professed ( I believe it was Erwin Rode) that when the price of a new house is the same or less than a second-hand home a bubble exits. This makes sense to me as clearly second hand houses are older and should be trading below what a new modern house would trade for, but if demand is so high that demand is driving up prices to beyond replacement cost, then supply of new houses should saturate the market bringing prices down and deflating the bubble. Does this ring a bell? Developers are still sitting on surplus stock that they have been unable to sell at launch prices, and very few are building.

But what I really want is a sign... to know is when is a great time to buy?

Surely the opposite applies, and when developers stop building because the large differential between new and second-hand homes exits, we have a buy signal? Take a look at the graph below, taken from the FNB Market Analytics:

Note how from 2004 the bubble started to develop as replacement cost relative to value dropped till it cost the same to build new than to buy second-hand. And we know what happened to property prices at the end of 2007 till 2009!

So put simply, the cost of replacing your home is becoming far more than your home is worth, showing surely that there is fundamental value in the property and at some stage the value will be pulled in line with the replacement cost or developers will not go back to work and a shortage of houses will come about, driving prices up again.

If you are interested in this topic or are interested in property investment, come meet and listen to myself and 7 property opinion leaders, book now to attend the PROPERTY WEALTH NETWORK function at a venue near you.