|

|

|

|

|

|

|

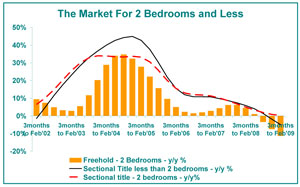

THE SMALLER-SIZED “2-BEDROOM AND LESS” MARKET REMAINS THE AREA WHERE THE WORST WEAKNESS APPEARS TO BE The market for 2 bedroom houses and less is where the weakness continues to appear worst, as compared to the 3 bedroom market. For the 3 month period to February 2009, the average freehold 2 bedroom house price (R307 141) declined by -11.3% year on year. This represents deterioration from -7.5% year-on-year deflation in the previous 3-month period. The sectional title “2 bedroom and less” market continued to fare slightly better but nevertheless continued with very weak performance in the 3 month period to February 2009 as well. The average price of sectional title 2 bedroom houses (622,655) showed a slight 0.3% year-on-year rise using revised figures, although still on a downward trend, the average price of sectional title units with less than 2 bedrooms (R426,403) declined by -5%. |

|

|

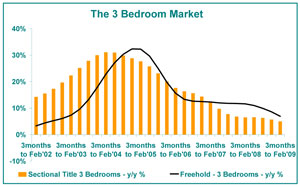

It has been previously explained that the possible reason for the apparent superiority in performance of the 3 bedroom market compared to 2 bedroom and less sectional title property, is that much of the buy-to-let surge back in the boom years was focused on the sectional title 2 bedroom and less market, as was much of the first time buying attention that we saw at the time. That may have explained the sectional title market for 2 bedroom units and less showing the highest price inflation of all of the major categories back at the peak of the boom around 2004/05. But it was also mentioned that, buy-to-let buying and first time buying has a tendency to be more cyclical than the more essential primary residential buying. Hence, a more extreme pull back in buy-to-let and first time buying in the bad times (compared with established family primary residential demand) may be the driving force behind the “2 bedroom and less” market now performing worse than the 3 bedroom market. The 3 bedroom market is probably a more primary residential buyers’ market, driven by family demand. *Note: While other room size categories not mentioned are included in the overall price index, their sample sizes are believed to be too small to justify the compilation of their own price index |

|

|

REAL PRICE DEFLATION STILL RAMPANT |

|

|

ONGOING DETERIORATION IN THE GLOBAL ECONOMIC ENVIRONMENT KEEPS PROSPECTS FOR 2009 WEAK Where does this leave South Africa? Definitely heavily affected by global events. The 2 highly-export-driven sectors of manufacturing and mining are where the global impact is being felt most, and the South African economy followed the global economy into contraction in the fourth quarter, with real GDP declining by -1.8% on a quarter-on-quarter annualised basis. |

|

|

The positive side to this very weak economic situation is the likelihood of low inflation in the near term, and the SARB is expected to reduce the repo rate by a further 100 basis points in April and June, with further cutting thereafter. Such interest rate cutting should provide some stimulus in what is a highly credit-driven market. However, under such a dire global and domestic economic growth scenario, with confidence-dampening retrenchments likely to be severe as a result, it would seem unlikely that aggressive interest rate cutting could be more than a very mild stimulus for residential demand at best. |

Property Advice

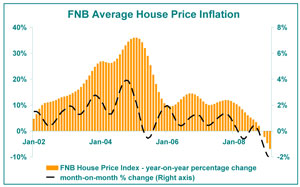

The year-on-year decline in the FNB House Price Index continued to gather momentum in February, from a January revised rate of -4.7% to -6.9% last month. This is the fourth consecutive month of average year-on-year house price deflation, and it continues to appear likely that this situation of national house price decline will continue for most of 2009. On a month-on-month basis -2.2% deflation was recorded, worse than the revised -1.9% of the previous month.

The year-on-year decline in the FNB House Price Index continued to gather momentum in February, from a January revised rate of -4.7% to -6.9% last month. This is the fourth consecutive month of average year-on-year house price deflation, and it continues to appear likely that this situation of national house price decline will continue for most of 2009. On a month-on-month basis -2.2% deflation was recorded, worse than the revised -1.9% of the previous month. This ongoing deflation is the lagged response to a decline in demand dating back to 2007. Rather than being reflective of the recent global recession, it is likely that the deteriorating house price trend is still largely reflective of rising inflation and interest rates up until mid-2008, and unfortunately this means that the negative impact of the more recent recessionary conditions probably still has to be seen. This would suggest that the rate of house price deflation will probably get worse before it gets better.

This ongoing deflation is the lagged response to a decline in demand dating back to 2007. Rather than being reflective of the recent global recession, it is likely that the deteriorating house price trend is still largely reflective of rising inflation and interest rates up until mid-2008, and unfortunately this means that the negative impact of the more recent recessionary conditions probably still has to be seen. This would suggest that the rate of house price deflation will probably get worse before it gets better.

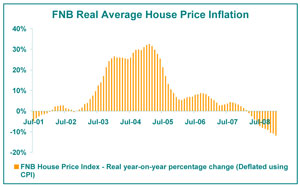

In real terms, when adjusted for general inflation by using the Consumer price Index (CPI), house price deflation also picked up further downward speed –on-year to -11.8% year, in January from -10.8% in the previous month, despite falling consumer price inflation. It must be remembered that a new CPI measure was used as from January, so it is not entirely comparable with prior months. However, the new CPI measure dropped significantly but even this was insufficient to offset the nominal house price deflation rate.

In real terms, when adjusted for general inflation by using the Consumer price Index (CPI), house price deflation also picked up further downward speed –on-year to -11.8% year, in January from -10.8% in the previous month, despite falling consumer price inflation. It must be remembered that a new CPI measure was used as from January, so it is not entirely comparable with prior months. However, the new CPI measure dropped significantly but even this was insufficient to offset the nominal house price deflation rate.

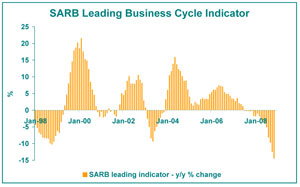

By November, the SARB’s Leading Business Cycle Indicator was declining year-on-year at a rate of -14.5%, which bodes ill for economic growth prospects in the near term.

By November, the SARB’s Leading Business Cycle Indicator was declining year-on-year at a rate of -14.5%, which bodes ill for economic growth prospects in the near term.