Make sure you know exactly what you're in for, when it comes to all the costs involved with buying as well as selling property.

Advertising Costs

If you use the services of an estate agent, this cost is usually covered by the estate agent.

Compliance Certificates

An Electrical Compliance Certificate is required by law for the property to be transferred to the buyer's name. This, and any electrical repairs that need to be made, is for your account. You may also be required by the buyer's bank to provide a Beetle/ Infestation Clearance Certificate.

Rates and Taxes Clearance Certificate

This is obtained from the local authority or body corporate stating that your rates and taxes or levies are paid up to date.

Rates and taxes have to be paid 4 – 5 months in advance before registration, of the property into the name of the new buyer, can take place.

Bond Cancellation Fees

This is paid to the Cancellation Attorneys for cancelling your existing bond.

Estate Agent's Commission

This is usually a percentage of the selling price. There is no set rate of commission. The rate of commission is negotiable with the estate agent.

READ MORE: Here’s how to get the most out of your estate agent

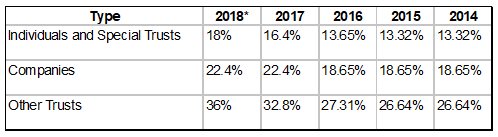

Capital Gains Tax (CGT)

For Individuals and special trusts:

- the maximum marginal capital gains tax rate is 18%.

- the first R 40 000.00 of capital gain/loss per year (2017/18 tax year) is exempt from CGT.

- the “primary residence” exemption is as follows: As a natural person/s, if you sell your home (which is personally occupied by you), for a gain/loss of R 2 million or less, the sale is exempt from CGT.

For corporate taxpayers or other trusts, no exemptions are available! This means that corporate homeowners (CCs or companies or trusts) are faced with a high CGT bill when disposing of the underlying property in which the members/directors/trustees resided, at a flat rate of 22.4% for companies/cc’s and 36% for trusts.

*Proposed rates as announced by the Minister of Finance in the 2018 Budget.

*Proposed rates as announced by the Minister of Finance in the 2018 Budget.

Moving Costs

Moving costs can only be obtained by getting quotations from removal companies.

How much does it cost to sell your home?

The costs involved in selling a house can add up quickly, and selling a house in South Africa costs a fair amount, which is why you need to be prepared for every process that will come your way. From the cost of advertising your house, obtaining compliance certificates and a rates and taxes clearance certificate, to bond cancellation fees, estate agent’s commission and capital gains tax, these are all the potential house selling costs you need to be aware of.

Private Property is an easy-to-use online portal available to help you find your dream home through listing South Africa’s top homes currently on sale.

Discliamer: Every effort is made to ensure the correct figures are stated on the date of update of this article. Please refer to the latest edition of Property Power for up-to-date information.

This article originally appeared in Property Power 11th Edition Magazine. To order your copy at the discounted price of R120 click here.