Absa Trust Fiduciary Consultant, Daron Gardiner LLB, presents and answers the most frequently asked questions about inherited property. In Part Two, Gardiner covers the implications of a trust, taxes, and the costs associated to an inherited estate and insurance policies.

See Part One, in which Gardiner explains the need for a Last Will and Testament, what it covers, the executor’s role, and implications on inheritors.

Q: What is meant by a 'trust', and why is it considered the best way to inherit?

There are two different types of trusts, an inter-vivos Trust - a trust established during your lifetime - and a testamentary trust - a trust that is established in accordance with the instructions contained in a Last Will and Testament.

As part of this discussion we will only be expanding on testamentary Trust as this is an instrument that is traditionally used in a Last Will and Testament where children are nominated as heirs.

The trustees named are responsible for managing and distributing the deceased’s assets to the beneficiaries as directed in the Last Will and Testament.

South African legislation only allows for two possible ways that a minor can inherit through a Last Will and Testament:

Option 1: By having the inheritance portion placed in the Guardians Fund which is administered by the Reserve Bank until the minor attains the age of 18 years, whereupon the full inheritance will be transferred into his/her name.

Option 2: A minor beneficiary whose inheritance portion has been placed into a testamentary trust has the ability to draw an income from the trust until a predetermined age, upon which the capital will be paid to that particular heir. Eg: Age 25.

With a testamentary trust there is also the ability to ensure that guardians and other interested parties act as trustees and control the assets to the benefit of the minor heir. This will ensure that the minor beneficiary is left with the best possible outcome. Other reasons for establishing testamentary trusts include ensuring that assets are protected from heir’s creditors. Additionally, they are important in cases where the heir cannot be left to their own devices with a large capital inheritance, and guidance is needed with the management thereof.

Q: What are the implications of not having a testamentary trust?

A: Should a testamentary trust clause be omitted or should a person pass away without a valid Last Will and Testament, the inheritance portion of the minor will be placed into the Guardians Fund. Once in the fund, there are various processes that the surviving spouse or legal guardian has to endure in order to handle matters pertaining to an income for the benefit of the minor, even should that income derive from selling the property that the minor inherited. The parent/guardian has no control of the assets once released to the heir upon the age of 18 years.

It is always best to place a minor heir’s inheritance portion into a testamentary trust. This ensures that those who are trusted, will administer the minor’s assets to the best of their ability, ensuring proper legacy planning.

Q: If an underage child inherits the property and is old enough to express that she/he does not want to sell it, what happens to the property?

Should a minor heir, with the agreement of his/her parent or guardian not wish to sell a property and the property has not specifically been instructed to be sold by the deceased in the Last Will and Testament, the property will then form part of the minor heir’s inheritance portion. The agreement by the parent or guardian is legally essential in this case.

Q: As an inheritor, what are the taxes imposed?

A: There are two main taxes imposed on an estate: Estate Duty and Capital Gains Tax.

Estate duty:

A person who passes away, and leaves his/her entire estate to his/her spouse, will not be liable for any estate duty payable in their estate. However, should any person bequeath any assets to any persons other than their spouse, and this includes trusts, there will be estate duty payable.

Every person is granted an Estate Duty abatement of R3,500,000.00 upon their death. In layman’s terms, you have R3,500,000.00 to give to someone other than a spouse, tax free. Anything exceeding this amount, will be liable for 20-25% Estate duty, depending on the estate value.

However, should a person bequeath his/her entire estate to their spouse, the R3,500,000.00 abatement, is passed onto the spouse. This means that when the longest living of the couple passes away, that person has an abatement value of R7,000,000.00 to bequeath, tax free, to nominated heirs.

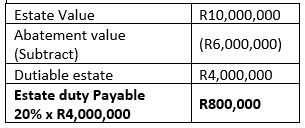

Let’s use an example: Harry passes away and leaves R1,000,000.00 to his son and the residue of his estate to his spouse. Harry’s abatement value of R3,500,000.00 will be reduced by R1,000,000.00 and R2,500,000.00 will be passed onto his spouse. When Harry’s spouse passes away, with an estate value of R10,000,000.00, and leaving the entire estate to her son, her abatement value will comprise of Harry’s R2,500,000.00 plus her R3,500,000.00 abatement.

The estate will then only be liable to pay estate duty on the following:

Capital Gains Tax (CGT):

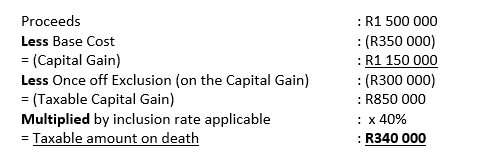

It is important to note that in terms of South African law, the death of an individual is treated as a disposal of the deceased’s assets and therefore CGT is applicable and payable by the estate. However, all South African citizens who pass away have a once off exclusion of R300,000.00. This means the first R300,000.00 of the taxable amount of the capital gain will be tax free. The example below uses a property’s original base cost at R300,000.00 accounting for its current market value at R1,500,000.00. The calculation would look like this:

The R340,000.00 will be included in the taxable income for the financial year and taxable at the deceased’s marginal tax rate.

Should the deceased fall in the 30% tax bracket, then the effective CGT applicable will be calculated as follows: R 440 000 x 30% = R132 000

Q: What is the law in terms of maintenance and rates/taxes that the property requires or is obligated to whilst the estate is being administered.

A: This question needs to be considered in light of the time it will take to administer the estate. Absa Trust’s view is that before any maintenance is carried out, a proper inspection of the property needs to be executed. If the maintenance issue poses the below-mentioned threats, and after consultation with all stakeholders, the proposed maintenance should be considered in light of:

• Endangering the life of the occupants

• The value of the property will be diminished should the property not be maintained.

Q: Do life insurance policies impact on property inheritance and can a beneficiary use this to pay off any outstanding mortgages?

A: In the case where an estate has a liquidity shortfall, the heir will be approached by the executor with the option of either paying the estate deficit into the estate late account to settle the liabilities or to allow the executor to sell off certain assets in order to cover all liabilities.

The most prudent advice will always be to settle any mortgage bond payable as soon as possible. Mortgage bonds attract various fees, interest charges and registration fees, all adding unnecessary financial strain on the heirs. Many of these financial pressures could be settled with life policy proceeds, should such be available.

Another consideration is that a bank may not be willing to re-mortgage a property onto a particular heir’s name, and that heir would then need to endeavour, on their own, to find a bank willing to mortgage the property.