The latest statistics from BetterBond, SA’s leading bond originator, provide the strongest indicator yet that the residential real estate market is in much better shape than most people think – and that the impetus is coming from the “affordable” sector.

“It may be more difficult to achieve home sales and prices may not be rising as fast as one would like, but the fact is that both the number and the value of transactions were up in all the major centres we monitor during the six months to end-September, when compared to the same period of 2017,” says BetterBond CEO Rudi Botha.

“And while an increase in value could just be attributed to higher home prices, the increase in the number of transactions confirms continued growth in the appetite for home ownership among SA consumers, which is very encouraging indeed considering the VAT, fuel price and municipal tariff hikes they have had to deal with in the past 12 months.

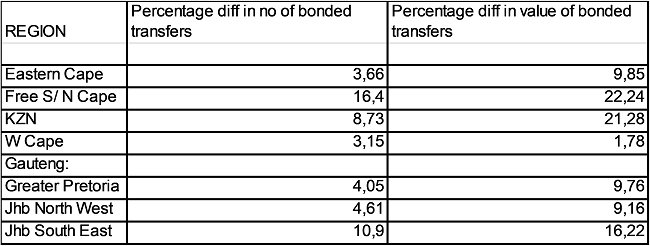

The figures show, for example, that in the Johannesburg South East region, the total number of bonded transfers of ownership registered in the Deeds Office between April and end-September this year was10,9% higher than in the same period of 2017 – and that the increase was even higher in the Free State / Northern Cape region (see table).

Rise in number and value of bonded transfers April-Sep 2018 v April-Sep 2017

Source: BetterBond and Lightstone

Source: BetterBond and Lightstone

Large number of buyers buying affordable properties for cash

What is more, he says, bonded transfers actually represented only 45% of all transfers that took place between April and September this year, with the rest being transfers as a result of cash purchases. But when it came to value, bonded transfers accounted for some 60% of the total.

“In other words, 55% of buyers currently are cash buyers whose transfers are only worth 40% of the total value - and that indicates a large number of buyers who are acquiring lower-priced properties for cash.”

Statistics compiled for BetterBond by independent property data company Lightstone show that in real terms, the total number of transfers registered in the Deeds Office during the second and third quarters of this year was just over 135 000, with a total value of just over R125bn. This means that about 75 000 buyers put R50bn of their own money into real estate during that period.

“At the same time,” says Botha, “our own stats show that the banks are continuing to back this market strongly, with our bond approval ratio currently running at 83% and the actual number of bond approvals up 5,5% in the 12 months to end-October compared to the previous 12 months.

“In addition, the total value of bond approvals showed year-on-year growth of 14% at end-October, reflecting more lenient deposit requirements that make it easier, especially for first-time buyers, to gain access to the market. Nevertheless, we continue to advocate that all home buyers who need a bond – and especially those at the lower end of the market, should try to save up as large a deposit as possible.”

The reason, he says, is that owners with deposits can expect more competitive interest rates and thus significant savings over the lifetime of their bonds. “For example, the average variation between the best and worst rate offered on a bond application is currently around 0,5%, and on a 20-year loan of R1,5m, this translates into potential savings of R6000 a year off your home loan instalments, and more than R120 000 worth of interest over the lifetime of the loan. We think that’s worth saving for.”

Read more: The affordable property market is outperforming the rest