The Masterdeeds Leak has put millions of South Africans at risk of identity theft. Ekaya offers you a chance to take control of your data.

The recent Masterdeeds Leak has seen the private details of over 31 million South Africans find their way into the public domain. The massive leak included ID numbers, contact details, addresses, and income estimates.

The leak has put millions of South Africans at risk of identity theft, a growing billion-rand problem, that is already costing South African businesses in excess of R1 billion a year.

The crime can take many forms and its impact can be devastating for those who are targeted. Aside from the obvious “loss” of your Identity, the consequences of ID theft can include damage to your hard-won credit score, being stalked, or even the discovery that you have been wrongly accused of a crime.

According to research from Experian’s Victims of Fraud team, it takes an average of 292 days for people to discover their information has been used for fraudulent purposes, so fraudsters could wreak havoc with your credit score while you remain blissfully unaware. A victim’s account of how devastating identity fraud can be, provides a cautionary tale.

A local cellular network called the ID theft victim telling him that he owed R21 000 across five cell phone contracts all in his name. He submitted an affidavit to dispute this and reported it to the Pretoria North Police Station. “I was denied opportunities of employment as they check my credit report and they see the credit history, am harassed by people pushing loans to help me settle my credit which I am not liable for. I can’t even apply for credit anywhere, I can’t even get a clothing account.” Once they have your personal details, criminals can convincingly pose as you and use your ID to open bank accounts, purchase items or services on credit and even apply for loans.

How to detect ID fraud

The best way to detect ID fraud is to regularly check your credit status. Most frequently, people find out that they have become a victim of ID theft when they hear from a credit provider or debt collector about an account or debt they know nothing about. However, by reviewing your credit report periodically, you are able to check that no unknown credit accounts have been opened under your name or transactions incurred on your behalf. If you spot an unfamiliar “new” account linked to your credit profile, it could be a warning sign that fraudsters have stolen your ID.

Three ways to check your credit report

- My Credit Check

www.mycreditcheck.co.za

A service from Compuscan that offers a comprehensive credit report via a monthly subscription.

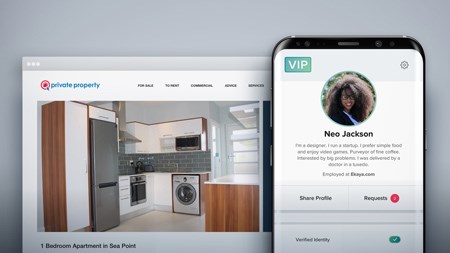

VIP by Ekaya

www.ekaya.com/vip

Their acclaimed, user-first ID verification and comprehensive credit report system with easy monthly refresh.

Experian www.experian.co.za A free consumer credit check that offers a credit risk rating, detection & alerts and ID verification.

VIP by Ekaya

The simplest and safest way to safeguard yourself.

Ekaya VIP combines identity verification, credit reporting and affordability calculator in one easy to use solution While VIP was designed to help tenants and landlords connect and exchange information simply and securely during the rental application process, they’re extending an invitation to all South Africans to make use of the service in order to safeguard themselves against identity fraud.

It takes less than 5 minutes to sign up, answer 5 questions and get a detailed credit report that is encrypted so that only you can see the information.

Get 50% off VIP

Ekaya is offering a 50% discount on the VIP service for the next month, to help South Africans take control of their personal information. The cost this month is just R49.