Positive sentiment around the South African residential property market dropped for the second consecutive quarter, according to ABSA’s Homeowner Sentiment Index (HSI).

The Index measures the sentiments of a sample of urban consumers with regards to various aspects of the residential property market.

Positivity around the property market declines

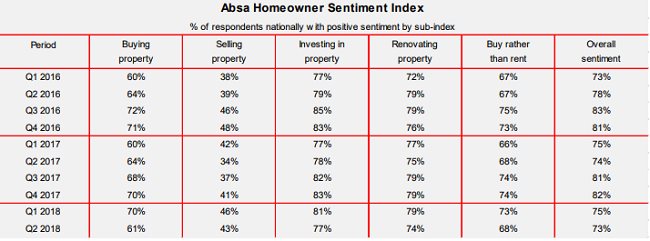

The overall national HSI score, which reflects the percentage of survey respondents with positive sentiment regarding residential property market conditions in the country, declined to 73% in the second quarter of 2018 from 75% in the first quarter and 82% in the fourth quarter of 2017.

The main positive and negative factors

The main positive and negative factors mentioned by survey respondents were as follows in the second quarter of the year (percentage of respondents in brackets):

• Positive factors:

Property is a secure asset (36%) and still increases in value (22%).

• Negative factors:

The land reform issue causes uncertainty regarding property as an

investment (25%), some political uncertainty still prevailing (25%).

Breaking down the results

The HSI is subdivided into 5 main aspects of the property market, all of which were lower in Q2 when compared to Q1 – an indication that consumers remain cautious of market conditions and influencing factors.

Below are the results of the 5 sub-indices

1. Buying property

Positive property-buying sentiment in Q2 dropped to 61% from 70% in the first quarter. Most survey respondents cited tough economic conditions as the main negative factor – not surprising considering the recent tax, rates and fuel price hikes.

The main reasons why the majority of respondents were still in favour of buying property were as follows:

• Property still increases in value and is a good investment (35%).

• Property prices are relatively low and there are bargains in the market (27%).

• Interest rates are low (7%).

2. Selling property

The positive sentiment towards selling property declined to 43% in the second quarter of the year from 46% in the first quarter.

The main reasons mentioned for selling property were the following:

• Property prices are relatively high and you may get a good price when selling (41%).

• Many people want to own property, which is supportive of selling (11%).

• Land expropriation without compensation causes uncertainty regarding property as an investment (7%).

3. Investing in property

There is less positive sentiment regarding property as an investment, which declined to 77% from 81% in the first quarter and 83% in the fourth quarter of last year.

The issue of land reform was indicated by 20% of survey respondents as the main negative reason.

Reasons in favour of property investment were as follows:

• Property remains a good investment (29%).

• Property still accumulates in value (15%).

• There is a demand for rental property (13%).

4. Renovating property

A total of 74% of survey respondents displayed positive sentiment in the second quarter of 2018 regarding renovating property, compared with 79% in the first quarter.

The main reasons mentioned in favour of renovating property were the following:

• Renovation increases the value of a property (37%).

• Constant upgrading of a property is important, especially if wanting to sell (13%).

• Building materials are well priced (10%).

5. Buying vs renting property

The positive sentiment regarding buying rather than renting property dropped to 68% in the second of the year from 73% in the first quarter.

The main reasons mentioned in favour of buying versus renting property were as follows in the second quarter:

• It is better to buy and pay off your own mortgage bond than rent and pay someone else's bond (35%).

• Property still increases in value and is a good investment (21%).

• Property prices are relatively low and there are bargains in the market (19%).

The outlook for the rest of the year

Despite a cut in lending rates in late March this year, existing and prospective homeowners’ financial positions are adversely affected by factors such as higher taxes and sharply rising fuel prices, with the aspect of land reform impacting property market sentiment over a wide front.

These factors are expected to continue to effect sentiment for the rest of the year, which will in turn effect market activity, buying patterns, transaction volumes, property price growth and the demand for and growth in mortgage finance.