There has been a reported increase in black buyers entering the South African property market but the market in general is slowing down as the ailing economy starts to bite,according to Rhys Dyer, CEO of ooba.

The latest property market report from ooba has indicated that the demographic of buyers is changing, with an increasing number of black buyers entering the local residential property market in the past year. Says Dyer: “This reflects the changing economic demographics in South Africa. Black home buyers represented 62% of applications received by ooba in the second quarter of 2016, a 4% increase on the same period in 2015. Similarly, 73% of all applications received from first-time home buyers were from black home buyers compared to 70% in 2015.”

Property price growth slows

The outlook for the property market in general is less positive as price growth slows down.

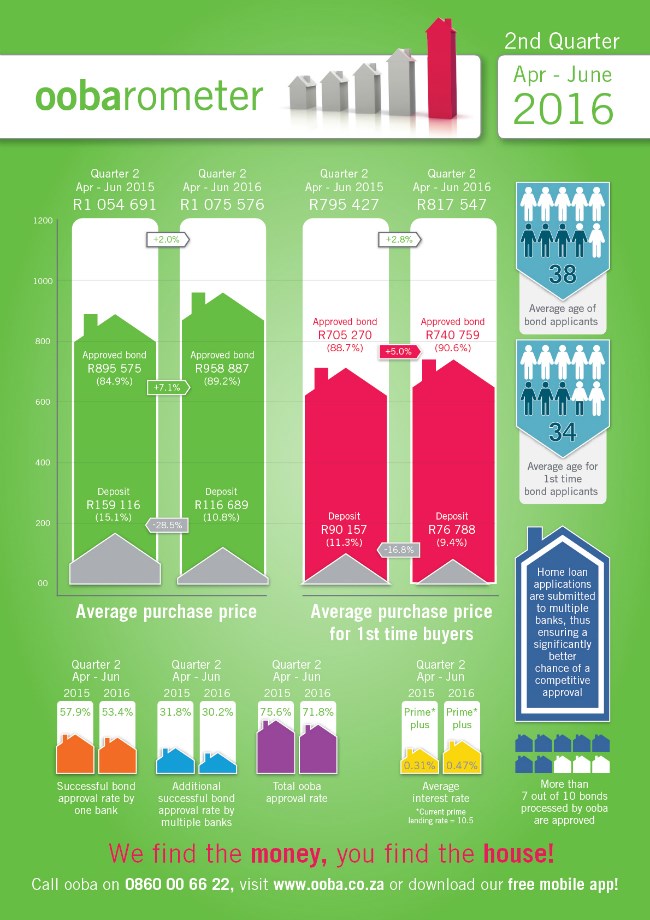

Property prices grew by just 2% year on year in the second quarter of 2016 compared to 6.2% in Q2 2015, according to mortgage originator ooba.This emphasises the sharpness of the decline according to Dyer.

“Slowing economic growth, increasing unemployment, escalating inflationary pressure and higher interest rates continue to erode consumer affordability. Consumer confidence is at its lowest level in years. With property price growth below Consumer Price inflation, we expect zero to negative property price growth in real terms for a while to come,” adds Dyer.

First-time Buyers’ Purchase Price fared slightly better, increasing by 2.8% year-on-year.

Increase in the size of bonds being approved.

There is a distinctive trend towards bonds of higher sizes being approved, up by 7.1% from around R896 000 last year to around R960 000. The Average Deposit as a Percentage of the Purchase Price is down by a substantial 28.5% year-on-year. Dyer says: “Although these trends appear to indicate healthy competition amongst banks, in reality it is probably indicative of the mix of business accepted by banks rather than banks relaxing their deposit requirements. Banks continue to be circumspect in their selection of successful bond applicants”.

Fewer bonds being approved

Consumer affordability pressure is confirmed by lower bond approval rates, down by 4.5% year-on-year from the second quarter of 2015. Dyer says lower approval rates indicate increased housing and mortgage finance affordability pressure on home buyers along with the escalating costs of lending. The year-on-year increase of 16 basis points in the average interest rate in Q2 of 2016 illustrates the increased cost of credit.

“Obtaining a home loan in the current economic environment is challenging. Our bond origination services take the pressure off prospective home buyers by dealing with banks on their behalf. At an approval rate of 72%, ooba continues to have one of the highest approval rates in the market. Our clients can therefore focus on finding their dream home, while we use our expertise to source the most favourable home loan,” concludes Dyer

ooba infographic

ooba infographic