|

“We estimate the total value of these properties to be about R240 billion with an average value of R174 000. Of these 175 000 are bonded for a total of R22 billion.” Townships in all provincesIn terms of provincial split of township properties, Watt says you’ll find 44% of these in Gauteng, 14% in KwaZulu-Natal, 11% in the Eastern Cape, 7.5% in the Free State, 6% in Mpumalanga, 5.8% in the North West, 5.9% in the Western Cape, 3.7% in Limpopo and 1.3% in the Northern Cape. “The house price appreciation in the townships has remained positive, probably in mid-teens in early 2009,” says Watt. Lightstone has also recorded a steady growth in the value of township property. “Since 2003, growth rates have ranged from 10% to 34%, with 2008 achieving a growth rate of 21% from the previous year.” Township house price indicesFNB property strategist John Loos updates his township house price indices each quarter. In the 4th quarter of last year the index was up 13.6% year-on-year. Statistics provided by Loos show that over the past 10 years the price of township houses has steadily increased from between R50 000 and R70 000 in 1997 to between R240 000 and R280 000. The biggest increases were between the end of 2005 and the beginning of 2008 when year-on-year prices leaped as much as 40% in some areas. In the fourth quarter of 2008, the average price of a township house in Gauteng was R292 163; in the Western Cape it was R225 365, and in KZN it was R244 292. Khumbulani Mvela owns KK Mvela Properties in Durban. He has been an estate agent for 12 years. As a veteran of township properties, he is well placed to talk about the market, especially in Umlazi and KwaMashu where he specializes. “The market is booming. There is always demand for properties in these areas and there is a waiting list for properties. The problem is of course price and affordability. Only 20% of prospective buyers can actually afford to buy after you have taken into account the National Credit Act and other criteria.” Mvela says of the two dormitory suburbs in Durban, Umlazi is by far the most popular. “You would laugh: Some people who live in some sections of Umlazi, in N Section or W or PP sections, think they are more important than other people. They rate themselves the same as people who live in Durban North, so people always want to live there.” Mvela says you won’t find a house for less than R200 000 in Umlazi. You are likely to pay between R235 000 and R275 000 for an average, four-bedroom house in the township. Houses at the top end of the market have well-maintained gardens, perimeter fences, good burglar guards, garages, and outhouses. Mvela says these houses fetch rentals of R2500 a month without a problem. But, he predicts that Umlazi, in the south of Durban, will eventually lose its shine because of crime. KwaMashu, in the north of Durban, will attract more buyers and even buy-to-let investors because it’s also in demand and prices are much lower. “In KwaMashu you can pick up something for R130 000. In two years it will be more popular than Umlazi.” Umlazi also has a new shopping centre, an R110-million building that went up more than two years ago, with Spar as the anchor tenant. Cape Town - middle to low-income marketIn Cape Town, Charity Maphosa is an independent estate agent who specializes in the middle to low-income market, mostly in Khayelitsha and Blue Downs. Though she’s new to selling property, Maphosa has 15 years experience as a conveyancing secretary and has sold three houses since January this year, when she went out on her own. According to Maphosa, there’s an activity in the township market but it’s no great shakes. She says there’s plenty of interest from buyers, but not a lot of stock. The demand for housing in townshipsThe demand for housing in the townships is great. And, unsurprisingly, she says when people migrate from informal housing to formal housing, they aren’t in any hurry to move. Another agent, who works mostly in Khayelitsha, Mitchell’s Plain and Standfontein, describes the market as slow. Over the past three years, he has sold only six houses in Khayelitsha. He says houses range from about R190 000 for a two-bedroom home to R250 000 for a three-bedroom home. The houses that Maphosa has sold ranged in price from R170 000 to R230 000. “The R170 000 house was priced well because it was an urgent sale. The couple was getting divorced and the house was vacant,” she explains. “It was a four-bedroom home, though the rooms were very small.” Maphosa says that all the houses she has sold have been RDP houses that were extended. “I’m finding that a lot of sellers are going back to the Eastern Cape to retire,” she says. The Kuyasa Fund is a non-profit organization that provides microfinance to poor people who qualify for a housing subsidy. Kuyasa has six branches in the country. Nationwide, they process between 300 and 400 loans a month to the value of about R2 million. Cape Town branch manager Zainab Panday says that Kuyasa is doing well because it meets a need for finance in the lowest end of the market – a market for which the banks don’t cater. Loans for people in townshipsKuyasa provides loans to people who already own a property. “Most of our clients obtain their houses from the government and these would range from R30 000 to R50 000, depending on the size.” The most that Kuyasa will loan is R20 000, but only after the client has demonstrated an ability to pay back three smaller loans of R6 500, R10 000 and R15 000. Buying in townships can be a risky business, according to one Durban-based investor, who asked not to be named. The investor, who buys and sells repossessed properties in the townships, has been saddled with a house in Gugulethu for two years. She bought the house for R35 000 but can’t sell it because the occupants refuse to move out and the authorities won’t evict them. “I’ve got plenty of interested buyers, but every time they go to view the place, the occupants won’t give them access. In fact they scare the buyers off by claiming they own the house. I had similar problems with a property in KwaZulu-Natal, except the previous owner almost destroyed the house before he eventually moved out.” Townships in JohannesburgIn Johannesburg, Anthea Bressick has been working in the township property market for the past two years. Although her portfolio is national, she’s highly excited about Soweto. “I’m so positive about Soweto. It’s such a booming area. There’s reinvention going on there. It’s not a township anymore, it’s a suburb.” Anthea says her clients love Soweto for a number of reasons. “It’s safe, there’s a sense of community and such a rich cultural heritage.” She says that she’s encouraged by the market there. “The rest of the market is taking strain, but the township property market has lots to offer.” Anthea says her company is getting about 2 000 bond applications a month for Soweto. And she says there are good deals to be had in Soweto. “A mansion in Soweto goes for about R450 000 – it would go for double that if it were in Edenvale or Benoni.” A two-bedroom home in Soweto fetches about R190 000. Anthea also has many investors buying in Soweto. “There are great retail establishments, schools, police stations and, of course, the proximity to the CBD is a big attraction. 2010 has also created a real buzz in Soweto. The guesthouses and B&Bs there are really stunning and will attract many.” Anthea predicts that of the townships in Gauteng, Soweto, Mamelodi and Cosmos City are the ones to watch. “We’re going to see great things happening in those markets.” |

News

Share this article

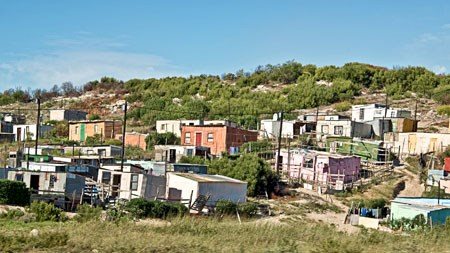

The township property market in South Africa is under strain, but perhaps not as much as suburbs across the rest of the country. This week we looked at prices and trends in townships around South Africa. According to Andrew Watt from property specialists Lightstone, there are 1.4 million township residential properties in South Africa.

The township property market in South Africa is under strain, but perhaps not as much as suburbs across the rest of the country. This week we looked at prices and trends in townships around South Africa. According to Andrew Watt from property specialists Lightstone, there are 1.4 million township residential properties in South Africa.