Private Property CEO, Simon Bray, provides insights on the property market for home buyers and investors.

Private Property's Simon Bray recently participated in a fireside chat on property at the Leaderex event held in Johannesburg. Leaderex brings together Africa's top executives, professionals and entrepreneurs for one day, to share knowledge and insights, offer advice to the next generation, network and collaborate.

We caught up with him after the event to get his view on some of the key questions facing property investors in South Africa.

What trends are you seeing in the market? Is there anything happening in the market that worries you, or that you feel investors are missing?

It’s no secret that the property market in South Africa could be doing a lot better. Subdued economic growth, very high unemployment, high levels of consumer indebtedness, lack of consumer confidence and political uncertainty has all contrived to slow property price growth.

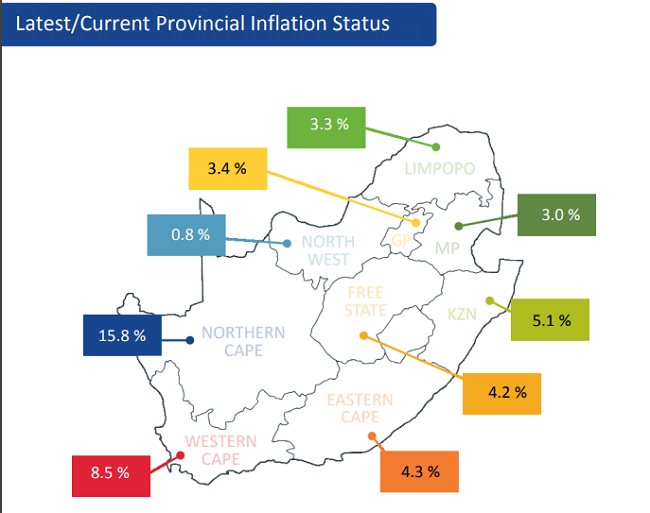

If you take a high level view of the market, growth has been very subdued. At a national level, you’re looking at growth of around 4%, and between 0.8% and 8.5% at a provincial level.

Property price growth by province Source: Lightstone

Property price growth by province Source: Lightstone

So, it’s not all doom and gloom – there is growth, albeit at a low rate. But a high-level look at the market doesn’t tell the full story. If you dive deeper into the market, there are some pockets of excellence – areas or property types that are performing exceptionally well, and buyers who identify these pockets and the underlying trends behind their popularity can make good buying decisions.

Some of the trends for investors to look out for:

• People want to be close to work, play, retail, schools – they don’t want long, expensive commutes. Areas like Rosebank, La Lucia, Cape Town’s CBD that offer that ‘live, work, play’ lifestyle are showing excellent growth.

• There is a trend in South Africa towards living on estates and property growth on these estates is on average higher than the rest of the market. Some of the estates on Private Property in the Pretoria East area are showing YOY price growth of over 20%

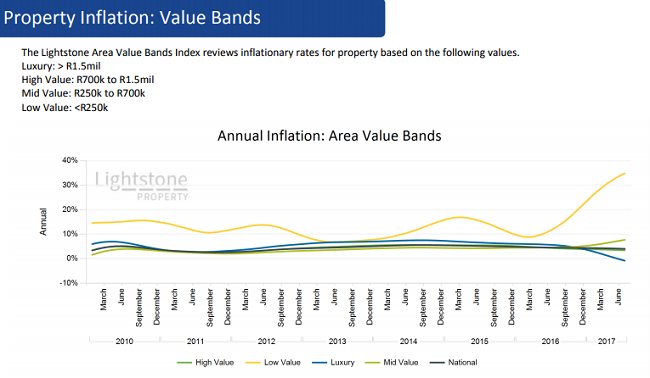

• The trend towards densification – buyers and tenants want smaller, cheaper properties with lower running costs.

Cheaper properties are showing better price growth than more expensive properties.

Property price growth by value band Source:Lightstone

Property price growth by value band Source:Lightstone

Is it really a buyer’s market at the moment, or are sellers holding out for their price?

It’s a combination of the two.

It is a buyer’s market at the moment – there is more stock on the market, properties are taking longer to sell and there are fewer qualified buyers in the market. But, what is contributing to the situation is sellers being unrealistic about their asking prices. There seems to be a large disparity between what sellers think their home is worth and what buyers in the current market are prepared to pay for homes. Buyers are aware that market conditions are in their favour and are therefore looking for a bargain where possible. Sellers need to understand that in some instances they are not going to get the large profits that were possible during the boom times.

Where are property deals being closed relative to initial asking prices?

Around 90% of sellers are having to drop their asking prices, so it’s quite high.

However, the amount that they are having to drop their asking prices by has dropped, from -8% for much of 2015 to -6.8% by the 2nd quarter of 2017. So more sellers are dropping their prices but by the are dropping their prices by less.

What is also worthwhile mentioning is that house price deflation (when a house is sold for less than the seller originally paid for it) has not increased. The majority of sellers are not losing money when they sell their property. The number of houses being sold for a lower value than the seller paid for it has remained below 10%, which is far lower than the 22% experienced immediately after the global financial crisis.

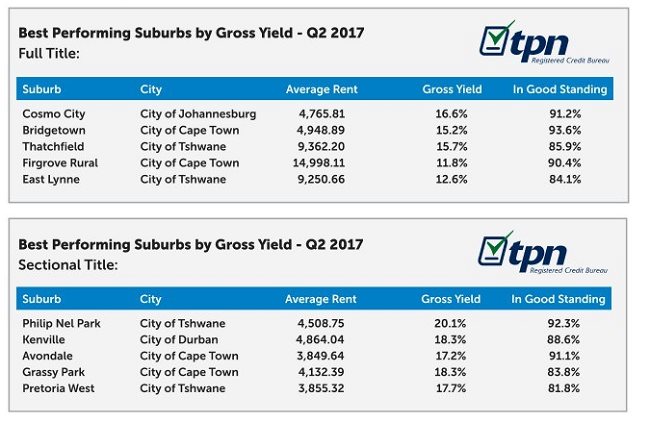

For a buy to let investor, which area of the market is looking most attractive? What sort of yields are investors achieving?

According to a recent report from TPN, of the 2.1 million households in formal rental accommodation in South Africa:

22% pay below R3000 a month,

59% are positioned in the R3000 to R7000 rental bracket

14% are in the R7000 to R12 000 bracket.

Only half a percent are paying above R25 000 a month. So almost 80% of tenants pay below R7000 per month. The sweet spot in terms of rental collection is the R3000 - R7000 bracket. The most challenging tenants (bad payers) are those that are paying below R3000 a month.

Best performing suburbs by rental yield Source:TPN

Best performing suburbs by rental yield Source:TPN

Property rates, water and electricity and other administered prices have been increasing at rates faster than general and rental inflation. How has this impacted clean yields that investors have been able to achieve?

It’s not an ideal situation for landlords. The increases faced by landlords have put pressure on their rental yields but the flipside of this is that the weaker economic outlook has also boosted demand for rental property. So landlords can improve their yields to a degree with higher rentals.

There is some good news on the horizon with inflation dropping and a drop in the interest rate, with another drop in the rate expected before the end of the year.

What sort of rental increases are investors able to push through in this economic environment?

The days of a standard 10% annual increase in rentals are long gone. Rental increases over the last few years have run at between 6% and 8%. Obviously, there is no one size fits all answer. How much you are able to charge depends on the demand for your property type and the area in which it is located. In Cape Town for instance, buyers have largely been priced out of the market so have no choice but to rent. Landlords can therefore charge higher rentals due to the extremely high demand.

It is however, prudent to keep rental increases at a reasonable level, especially if you have a good tenant in place. It is hard to evict bad tenants, so landlords might consider compromising on their increase in order to keep the good tenant in place.

4 things a landlord should consider before increasing a rental:

• The current economic climate

• What the rental market in the area is doing

• The quality of the tenant – do they pay in full and on time?

• Are they achieving an acceptable return on investment already?

Would you buy a property before the ANC elective conference?

At this moment, there is a lot of uncertainty about the future trajectory of the country – and this uncertainty is holding the country back as we adopt a wait and see attitude, so at least we’ll have clarity on what to expect after the elective conference.

Its generally accepted that the 2 favourites to emerge victorious from the ANC elective conference represent 2 quite different outcomes for the country.

On the one hand, you have Dr Dlamini- Zuma who will probably pursue the existing government policies. So we’ll probably see more the same – low growth, low levels of foreign investment, and political and fiscal uncertainty.

But, there isn’t really a reason to put everything on hold until after the elective conference. South Africans have factored uncertainty, the current economic outlook and rising costs into their property buying decisions already.

Investors and home buyers may find some excellent purchasing opportunities in the next few months– but they will also need to guard against the potential for negative equity by putting down significant deposits so that they immediately have a large stake in their properties.

We do not expect the property market to collapse or take a drastic turn for the worse in the event of the Dlamini-Zuma faction winning, but it is possible if a very radical, anti-business agenda is pursued.

The other scenario is that Cyril Ramaphosa wins and the country changes trajectory. If he wins and we see a more business and investor friendly environment created, with greater political stability we should see the market improve significantly.

For the property market to pick up, we need the economy to pick up and stability. Even a small amount of growth (2% to 3%) would give a huge boost to the market.

In this scenario, investors who buy before the elective conference will be in the pound seats as they would have bought at the bottom of the cycle.

Simon Bray speaking at Leaderex

Simon Bray speaking at Leaderex