Past, present and future - we track how the repo rate has impacted the property market, and what the recent rate cuts mean for home buyers and sellers.

Before the end of the year, economists anticipate a third repo rate cut. “I don’t know by how much,” says Dawie Roodt, Chief Economist at The Efficient Group, “but had the Reserve Bank not managed the country’s monetary policy as efficiently and restrictively as it has over the past few years, i.e.: by keeping interest rates relatively high in order to make sure that inflation remains contained, it would not be in a position to lower the rate now when it is needed the most.”

3 Things the reserve bank is doing which may have a positive impact on the property market:

There are essentially three things the Reserve Bank is currently doing, and which may impact positively on the property market and an individual’s ability to manage debt. The first is the cutting of short-term interest rates, which after the two pandemic-motivated cuts to date, have brought the repo rate down to 4.25%. Each time the repo rate reduces by 100 basis points, the interest rate is equally reduced by one percentage point.

Short-term interest rates affect the amount we are obliged to pay on our monthly debt vehicles, such as bonds, car finance, credit cards etc., which is what people tend to think about when there is talk around monetary policy.

“The second thing the Reserve Bank is enabling is the relaxing of certain capital and liquidity requirements applicable to banks,” explains Roodt, “In essence this makes it easier for banks to operate. In so doing banks can in turn make it easier for their customers to manage their finances. For example, banks may be able to postpone payments of debt.

“The third thing the Reserve Bank can and is doing, is printing money, with which it buys certain financial instruments on the financial market. This pushes down long-term interest rates.”

What Roodt makes clear however, is that these particular three solutions do not benefit the economy that much, but rather the people that own money. “People always pay a price for ‘money ownership’ particularly those that are mostly dependent on interest income, which is quite often the elderly.”

Pushing and pulling on a string

Control measures are therefore obviously needed. Reserve Banks do not want to manifest a situation where only the rich get richer, or the poor get poorer, or dependence relies on a small or niche sector of the population to subsidise interest returns. Among the myriad of considerations that a Reserve Bank makes before cutting or increasing the repo rate, is a complex number of potential chain-reaction scenarios. Roodt has dumbed down the most applicable to SA’s current crisis.

“Relative to monetary policy is a term ‘pushing and pulling on a string’. What this refers to is that by increasing interest rates, the Reserve Bank can eventually force people to stop borrowing money because it becomes more and more expensive to borrow. If you do the opposite, i.e.: cut interest rates, you cannot force people to borrow money … it’s like pushing on a string. And when people are scared and uncertain, even if interest rates were as low as zero, they will still not borrow money.

“This is where we are now. Some people may benefit through cash flow by the cuts in interest rates and some will pay the price. The economy is therefore not in a position to benefit much currently because fearful people are not going to be borrowing money and spending it.”

Interest rate not likely to increase over next two years

Roodt does however think that this is a good time to enter the property market, especially for first-time buyers. “If you have made up your mind to buy a home, a depressed market is always a good time to enter, provided of course you have a regular income and a finance institution is prepared to loan you the money to do so.

“There are of course the usual valid risks that apply, such as when the interest rates increase again, but I don’t believe this is going to happen soon,” says Roodt, who bases his statement on the fact that inflation is not much of a factor that has significant influence in the current market conditions. “I think interest rates will remain relatively low for up to two years at least.”

Where we may experience economic impacts created specifically by the property market, is in the buying and selling of homes. “This process creates change, and in my opinion it doesn’t matter what change manifests because it has a disruptive influence on economic patterns, and often the result is that something good pops out somewhere.”

Housing market survival

One of those “good” things is described by Adrian Goslett, Regional Director and CEO of RE/MAX of Southern Africa. “Although it is unlikely that we will see too great of an increase in qualified buyers as a result of the stimulated interest during lockdown of new property searches, the housing market still stands to benefit.

“Dropping interest rates allows struggling homeowners the opportunity to keep up with the instalments on their home loan. Fewer houses are thus forced onto the market, which lowers the possibility for a housing market crash where supply far outweighs demand and property values plummet.”

This of course addresses the fear of those considering selling in the near future, but should a flood of homes in the market lead to a downward pressure on asking prices, buyers in turn are incentivized to purchase. “This could lead to the market rectifying itself through a possible housing boom later down the line,” says Goslett.

Significance of rate cuts for bond holders

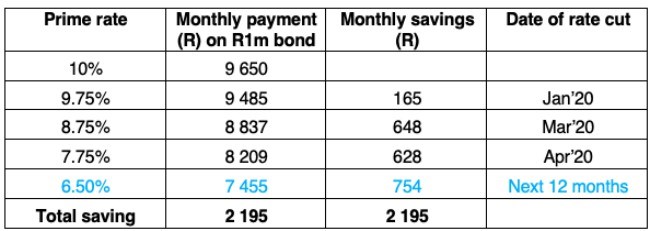

Dr Andrew Golding, chief executive of Pam Golding Properties also presents a good picture despite the unknown depth and extent of the recession and COVID-19 impacts. “Savings on monthly bond payments as a result of the 225 basis point rate cuts so far, equate to approximately R1441 per month, on a million-Rand home. Should the Reserve Bank apply, for example, another 125 basis point cut in the repo rate, this would further reduce the monthly bond repayment by R754.”

Golding supplied Private Property with a table (below), based on a home mortgage of R1-million. This clearly indicates the extent of the savings from the interest rate cuts to date. (Note that the last entry - 6.50% prime rate - is based on the assumption that the Reserve Bank may reduce the repo rate by 125 basis points in forthcoming months):

Even though savings like this may make a difference to households that are struggling through debt scenario’s caused by the loss of income of a contributor to the home loan, Golding and Goslett are in agreement that if possible it is preferable to keep a bond repayment unchanged even as interest rates decline.

“Homeowners should note that the interest saving and impact of the loan term (e.g.: years of the home loan repayments) will be less than it would be at the beginning stages of the loan term,” says Goslett. “The interest portion of the monthly bond repayment always decreases as more of the bond is paid off. This is attributable to the power and effect of compound interest, ultimately leading to shortening the lending term.”

If the choice is to use the savings, Golding recommends using it to repay other debt, such as vehicle finance or credit cards which are set at a higher interest rate than home loans. “The reduction in bond repayments will be a welcome financial relief, but of course this depends on individual circumstances.”