Buying property is a big financial commitment, which is why savings of any kind is welcomed. Applying for a home loan through a bond originator is one of the lesser-known ways to save significant money.

We sat down with Carl Coetzee, CEO of bond originator BetterBond, to give us the lowdown.

We keep hearing that now is the best time for people to buy property, especially if you’re buying your first home. Please explain why.

Firstly, the interest rate is the lowest it’s been in over 50 years. Secondly, Finance Minister Tito Mboweni announced in the Supplementary Budget Plan recently that personal income tax will not be raised, which means disposable incomes won’t be affected, making it possible for more people to enter the property market at this opportune time. There are also indications that another interest rate drop is likely later this month, and that too will provide further financial relief. These factors all improve the possibility of owning property for thousands of South Africans who might otherwise not have been able to afford it.

How should a prospective buyer go about getting a home loan?

Sourcing comparative bond quotes is the smartest way to ensure you get the best deal on a bond, meaning the most favourable interest rate based on your personal credit profile. A bond originator sources quotes from multiple banks by applying for a bond on behalf of the home loan applicant with the purpose of securing the lowest possible interest rate.

So you recommend that a person looks at obtaining quotes from more than one lender. Why does this make a difference?

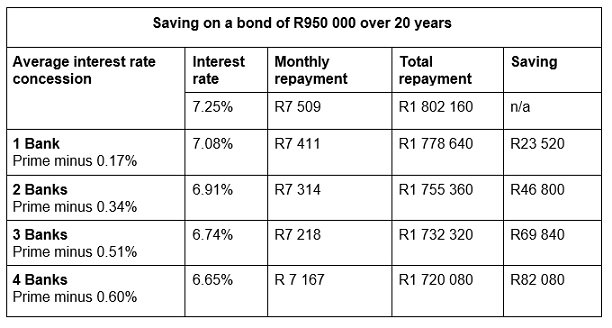

Not only do different bond quotes help secure the most favourable interest rate but the data also indicates that the more banks that are applied to, the more favourable the interest rate is likely to be. The table below shows the average interest rate concession a BetterBond client receives based on the number of banks applied to. These numbers highlight the difference a seemingly small change in the interest rate can make over a 20-year period. It also highlights the point around why it makes sense to apply to more than one bank.

What’s more, the applicant applying on his/her own directly to a bank tends to apply only to one bank which puts the odds of getting a bond at all or nothing. A bond originator, on the other hand, will always apply to multiple banks, which significantly increases the chance of bond approval. In fact, BetterBond’s own stats show that the average approval rate when applying to one bank is 53%, but this number goes up to an impressive 79% when applying to four banks.

Does a prospective buyer have to pay something for the process of applying for a bond?

Bond originators are paid a once-off fee by the banks for brokering the deal with the client, so there is no cost for the customer. Interestingly, too, financial institutions understand that home loan applications that come via a bond originator are also being submitted to their competitors, which often makes them more open to offering the client the best possible rate for fear of losing the business to another bank.

Are there any other reasons to go the route of sourcing bond quotes?

Beyond the noteworthy savings, a bond originator streamlines the application process and makes it as convenient as possible for the applicant by, for example, requesting that only one set of documents be completed. Bond origination consultants also know exactly what the various banks require from applicants, what their different home loan products offer, so they can tailor the application to ensure that it has the very best chance of being approved.