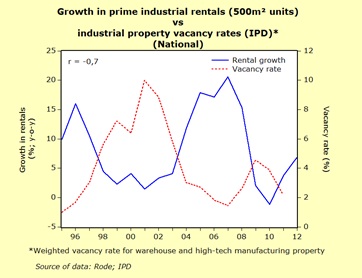

The growth in industrial rentals is slowly heating up, seemingly benefiting from the lagged impact of declining industrial property vacancy rates.

Evident from the graph which follows is the strong inverse relationship between vacancies and rental growth – exactly as one would expect. Note also how vacancy rates on warehouse and high-tech property dropped during 2010 and 2011, and how since 2011 the growth in prime industrial rentals has heated up. In fact, such has been the acceleration in the growth of rentals that in the fourth quarter of 2012, prime industrial rentals recorded a nationally averaged growth rate of 7%. Disappointingly, this growth failed to be in excess of building-cost inflation, implying that we are, as yet, not out of the woods when it comes to industrial property.

For now, the good news for the industrial property market comes from the manufacturing sector. Possibly thanks to a weak exchange rate, the yearly growth in output produced by the manufacturing sector has in recent quarters been gaining momentum. What’s more, in February 2013 the Kagiso Purchasing Managers Index (PMI) was again — after five previous months of weak readings — able to punch through the break-even index level of 50. The Kagiso PMI is an indicator of the overall health of the manufacturing sector; where 50 is a neutral number, and a reading of below 50 implies contraction, while a reading above 50 implies expansion.

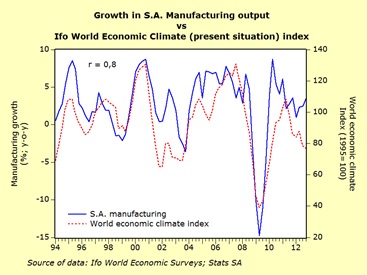

But, when not taking into account the export competitiveness that a weak currency brings in the short term, the current feeble global economic conditions presage continued tough times for the South African manufacturing sector. The Ifo World Economic Survey (WES) investigates world-wide economic trends by polling transnational as well as national organisations in different countries. Note — from the second graph — the correlation between SA’s growth in manufacturing output and the trend in the Ifo’s World Economic Climate index. Furthermore, note how the metric of the present world economic situation has been trending south since 2011. From this graph it would appear that the current uptick in SA manufacturing output might not be sustainable.

So do not go out there and do speculative developments or investing.