Analysis by a leading bank indicates that the housing market continues to weaken. Further interest rates cuts are key to the market turning around.

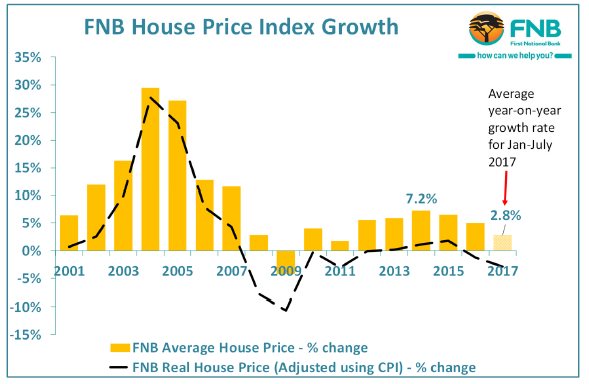

The FNB House Price Index so far for 2017, shows that average annual house price growth will slow down for a third consecutive year, and more worryingly, that house prices are declining in “real terms” for the second year in a row. Describing house prices in “real terms” gives a more accurate picture of growth by taking into account the effect of consumer inflation.

Average house price growth so far this year was 2.8%, which is down from the 5% recorded in 2016. In real terms (CPI inflation-adjusted), the average year-on-year rate of decline was -2.9% for the period January to June 2016, a weakening from the -1.2% average rate of decline for 2016 as a whole.

Slow house price growth could indicate an economic weak period ahead.

The housing market can often be a good leading indicator of economic conditions. After a slightly stronger economic performance at the start of the year, year on year house price data indicates that we could be entering a period of economic weakness.

The month on month house price slowdown, together with other variables that track the economy, like the Manufacturing Purchasing Managers’ Index (PMI) and the SARB Leading Business Cycle Indicator which have both declined recently indicate potentially tough times ahead.

The Leading Business Cycle Indicator decline is particularly significant, because the residential market’s activity as well as new mortgage lending growth typically tracks this indicator’s direction strongly. Recent renewed slowing in house price growth, therefore, does not come as a surprise.

Has house price deflation begun?

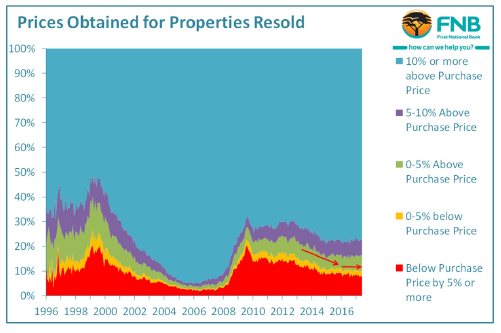

House price deflation occurs when a home is sold for less than the original purchase price. In the current climate, it would be realistic to expect a higher percentage of homes to be sold for less than the original price, however FNB’s data indicates that house price deflation has not risen significantly. In June, the estimated level of resale price deflation was 9.6% of total sales, which is not significantly different from 10.1% estimate as at the end of 2016, and far below the revised estimated 22.66% in August 2009, immediately after the economic crisis.

If the economy continues to show poor growth, the housing market might show further deterioration. One possible stimulus is the onset of SARB interest rate cutting, a 25 basis point repo rate cut having taken place in July. While one lone cut is not sufficient to move the housing market significantly, further cuts could lead to house price growth in 2018 being slightly stronger than that shown so far this year.