Repeat buyers currently make up the majority of the property market as first-time buyers struggle in the face of poor economic growth.

Repeat home buyers are currently the mainstay of the residential property market, accounting for 55% of new bond applications and 66% of formally granted home loans, according to the latest statistics* from BetterBond, SA’s leading bond originator.

“This is a positive indicator for the market,” says CEO Rudi Botha, “because it shows that despite the current political and economic uncertainties, most existing home owners are not selling up and extracting all their proceeds, but re-investing these into their next homes in SA.

“Indeed, even though consumers have been under tremendous financial pressure over the past 12 months, the average deposit paid by buyers in this sector has only declined from R223 000 to R220 000. And this has done much to sustain home price growth, which showed a year-on-year rate of 5,2% at end-August.”

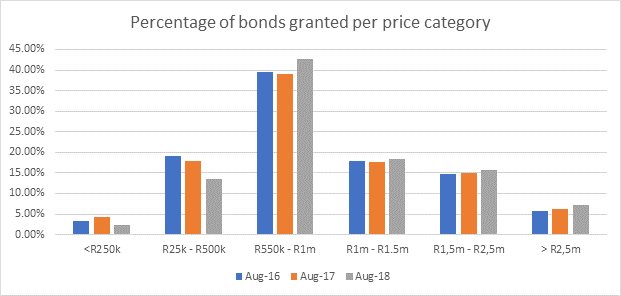

Growth has also been facilitated by the willingness of banks to lend more, he says, especially to buyers with substantial deposits, and this has caused the percentage of home loans being granted for amounts greater than R1m to rise to 41% in the past 12 months from 39% in the previous year and 38% two years ago.

“By contrast, though, there have been significant declines in the percentages of bonds being granted for less than R250 000 and for between R250 000 and R500 000 (see graph) – the home price categories which have traditionally been most favoured by lower-income first-time buyers with a housing grant or only a small deposit.”

And this is not such a positive sign for the future of the market, says Botha, as it suggests that many entry-level buyers are being squeezed out of the market – perhaps permanently - because they simply cannot afford the monthly bond payment, even though the banks are now often prepared to grant 100% loans to lower-income buyers with good credit repayment histories.

“Our stats show that the average home price in the first-time buyer sector has risen by almost 10% in the past 12 months to R842 000, and that there has simultaneously been good growth in the percentage of bonds granted in the R500 000 to R1m category.

“But that suggests that the income required just to enter the market has shifted substantially higher than the majority of SA households earn, that the ‘nursery’ of the market is shrinking and that the total number of market participants available to become repeat buyers will accordingly be constrained for some years ahead.”

In short, he says, significant market expansion is probably not to be expected now without lower interest rates, robust economic growth and rising employment numbers.

“Meanwhile, entry-level buyers who do want to get into the market now should note that originators like BetterBond are their best hope for doing so. We are currently obtaining approval for more than 80% of the bond applications we submit to the banks, but more importantly, we ensure than our clients are offered the lowest possible interest rates on their loans.

“And we are currently finding a variance of at least 0,5% between the best and worst rates being offered on the average bond approval – which could make all the difference to a buyer worried about being able to afford the monthly bond repayments. Even on a R500 000 loan, for example, the lower interest rate would translate into a saving of about R200 a month – and a total interest saving of almost R42 000 over the life of the bond.”