April's property statistics from ooba indicate a slowing down in property purchases.

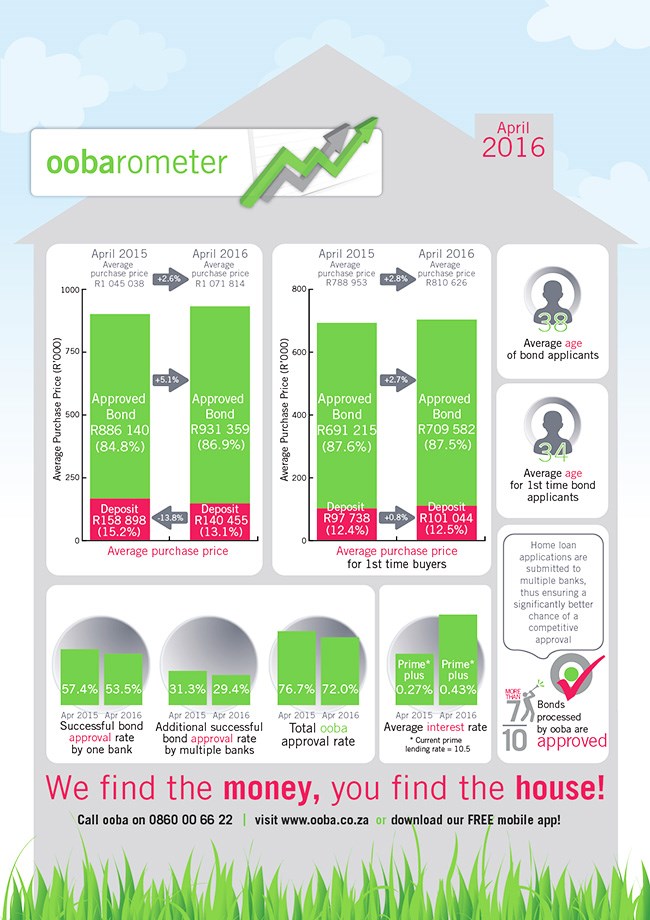

April property statistics from ooba, South Africa’s largest bond originator, indicate a significant slowdown in the year-on-year growth of the average property purchase. With an increase of only 2.6% since April 2015, average house price inflation has shown negative real growth against the current inflation rate of 6.3%.

The First-Time Buyers Purchase Price mirrors this trend, with annual growth of only 2.8%.

Rhys Dyer, CEO of ooba, says: “The slowing growth in property prices is a symptom of deteriorating residential property demand. Consumer confidence is waning in the face of South Africa’s poor economic growth, high inflationary pressures and increasingly expensive credit due to rising interest rates and higher funding costs for banks.

Dyer points out an emerging trend towards homebuyers entering the market with some form of deposit. The ratio of homebuyers applying for finance without access to a deposit was 36% in April and 37% in March, compared to 48% in April 2015.

The April statistics show that banks have increased their average pricing from 0.27% above prime in April 2015, to 0.43% above prime in April 2016, which coupled with interest rate increases, further impacts consumer affordability.

Dyer adds: “First-time Buyers are showing less activity in the market. Six months ago 54% of all our home loan applicants were First-time Buyers compared to only 51% in April this year. This probably explains why the average age of buyers has increased by one year to 38 years old for the first time since January 2009. The average age of First-time Buyers has also increased year-on year by one year to 34 years old.”

Says Dyer: “Our statistics show bond approval rates are down by -3.9% year-on-year, although there is a 0.8% increase month-on-month. Increasingly expensive credit and consumer affordability constraints naturally contribute to this higher decline ratio. By using the services of a bond originator, prospective buyers greatly increase their chances of obtaining successful bond approval with the most affordable terms, given current turbulent economic times,” concludes Dyer.