| On the back of tough economic conditions, house prices continued their declining trend in both nominal and real terms in most provinces, metropolitan areas and coastal regions in the second quarter of the year.

Nominal house price deflation is set to continue for the rest of 2009, starting to slow down towards the end of the year. House prices are forecast to decline by about 3,5% in nominal terms this year after growing by 3,7% in 2008. In real terms prices are set to drop by around 10,0% this year, taking into account projections for consumer price inflation and nominal price growth. This will be the second consecutive year of lower real house prices. The lagged effect of lower interest rates and a moderate recovery in the economy later this year are factors which will contribute to an expected gradual improvement in residential property market conditions from early 2010. Summary

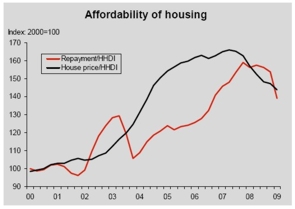

Economic overview The South African economy is in a recession after contracting by a real annualised rate of 1,8% in the final quarter of 2008 and 6,4% in the first quarter of 2009. Sharp declines were recorded in the real value added in especially the mining and manufacturing sectors in the first quarter of the year, while major job losses occurred in many sectors of the economy in the first half of the year. The construction sector, largely driven by major infrastructure projects, still performed relatively well in the first quarter, growing at a real annualised rate of 9,4%. The household sector remained under pressure in the first quarter of 2009 with the ratio of household debt to disposable income increasing to a level of 76,7% in the quarter from 76,3% in the fourth quarter of 2008. This was the net result from nominal household disposable income rising at a slower rate (0,9% quarter-on-quarter (q/q)) than household debt (1,4% q/q) in the first quarter. The cost of servicing household debt as a percentage of household income was somewhat lower at around 11% of disposable income in the first quarter (11,7% in the final quarter of last year), mainly as a result of declining interest rates in the first three months of the year. Growth in real final consumption expenditure by households contracted by a seasonally adjusted annualised rate of 4,9% in the first quarter of 2009, which is a reflection of the tough economic conditions, impacting employment, household income and consumer confidence. Real residential fixed capital formation contracted for the seventh consecutive quarter in the first quarter of 2009, by 7,3% year-on-year (y/y), after declining by 7,5% y/y in the fourth quarter of 2008. This is a reflection of a housing market that has slowed down further on the back of financial strains experienced by the household sector, as well as tight credit conditions. Declining trends in the number of building plans approved for new residential buildings, as well as the number of new residential buildings completed in the first five months of the year, confirm the current conditions experienced in the housing market and suggest that these tough conditions may prevail for the rest of the year. Growth in mortgage advances to the household sector, largely related to the residential property market, tapered off to 6,8% y/y in May 2009, which is a reflection of the relatively low demand for housing and mortgage finance. Economic outlook and prospects for the housing market The South Africa economy is forecast to contract by a real 1,9% in 2009, after growing by 3,1% in 2008. It will be the first recession in the South African economy since 1992, when real gross domestic product contracted by 2,1%. The current economic conditions are having a devastating effect on employment in many sectors of the economy, negatively impacting household income. Real household disposable income is projected to decline by 2,3% in 2009 (+2,5% in 2008) on the back of these developments. These conditions will have a negative impact on households’ final consumption expenditure, which is projected to drop by 2,6% this year, after rising by 2,3% in 2008. Especially durable household consumption expenditure will be hit hard, which is expected to drop by 14,5% in 2009, after declining by 5,2% in 2008. With headline consumer price inflation expected to reach the 6% level by mid-2010 only, the Reserve Bank’s Monetary Policy Committee is forecast to leave the key policy interest rate, the repo rate, unchanged in the rest of 2009 and into 2010. Banks’ prime lending and variable mortgage interest rates are thus projected to remain stable at the current level of 11% during this period. Nominal house price deflation is set to continue for the rest of 2009, starting to slow down towards the end of the year. House prices are forecast to decline by about 3,5% in nominal terms this year after growing by 3,7% in 2008. In real terms prices are set to drop by around 10,0% this year, taking into account projections for consumer price inflation and nominal price growth. This will be the second consecutive year of lower real house prices. The lagged effect of lower interest rates and a moderate recovery in the economy later this year are factors which will contribute to an expected gradual improvement in residential property market conditions from early 2010.   Download the full version of the Absa Housing Review - Q3 2009 |

News