Transfer duty is a tax levied on the sale of fixed property payable to the SA Revenue Service (SARS) when the property is transferred from the existing owner to the new owner.

The new owner – the buyer - is liable for the transfer duty in addition to the purchase price and other transfer costs such as conveyancing fees.

Transfer duty is based on the value – not the price – of the property, although SARS will generally regard the purchase price to be the same as the value. In some instances, SARS may consider that the purchase price does not correspond with the true value of the property. This may happen when a property is sold to a friend or a family member and its value is understated. Transfer duty will then have to be paid on the true value.

Rate of tax

The 2021 Budget Speech included an amendment to the transfer duty calculation applicable to property transactions, increasing the threshold under which no transfer duty is payable from R900 000 to R1 million.

This means that if you buy a property that costs R1 million, you will not have to pay any transfer duty. However, you will still be liable for the other transfer fees.

The rest of the transfer duty sliding scale is unchanged from the previous year.

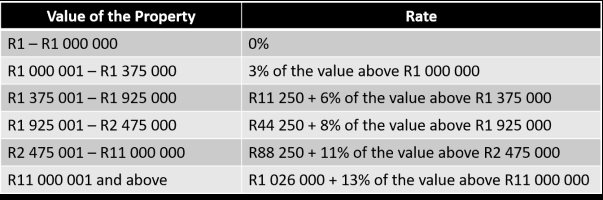

According to the latest SARS schedule, transfer duty rates are as follows:

VAT or transfer duty?

Property transactions cannot be subject to both VAT and transfer duty. If you are buying a new home from a developer who is a VAT vendor - as property developers generally are - then you will be liable for VAT – currently 15% of the price - instead of transfer duty.

VAT on properties in developments is usually included in the purchase price, along with the rest of the transfer fees. However, it’s advisable to check the offer to purchase to make sure there are no hidden costs.

Exemptions

Some property transfers are exempt from transfer duty.

Inheritance : Heirs and beneficiaries of deceased estates are exempted from paying transfer duty on property inherited through the estate. This applies whether or not there is a valid will and regardless of the nature of their relationship with the deceased.

Cancelled transactions : There is no liability for transfer duty if SARS is satisfied that the cancellation of purchase before the transfer is registered at the Deeds Office, is legitimate.

Marriage in community of property : If the owner of a property gets married in community of property, their spouse will automatically own a half-share of that property, without paying transfer duty.

Divorce : No transfer duty is payable on a property awarded to a spouse in terms of a divorce order. The exemption applies to all legal marriages as well as civil unions. However, if the divorcing parties reach an agreement separate from the formal divorce proceedings, the spouse who acquires the property will be liable for transfer duty.

Online assistance

Keep in mind that in addition to transfer duty costs, you’ll also need cash for a deposit, as well as legal fees and bond fees. The amounts vary enormously, depending on the purchase price of the property. Private Property offers online Bond Affordability and Bond Repayment Calculators which allow you to work out how much you can afford before you start your property search.