The latest stats from ooba indicate that although house price growth has slowed, lower prices and easier access to credit is benefitting buyers.

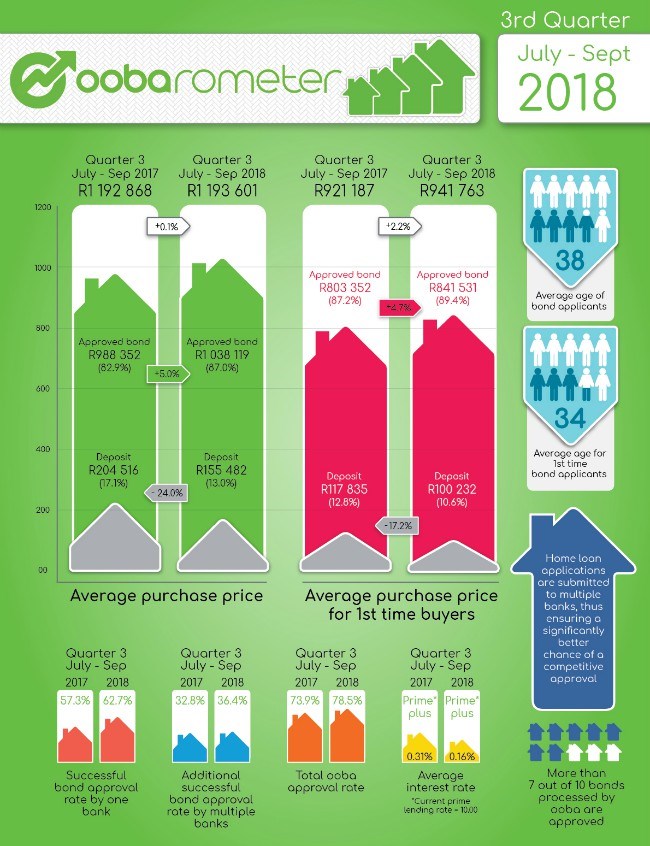

Third quarter (Q3 18) statistics released by ooba, South Africa’s leading home loan originator, show that year-on-year from Q3 17 to Q3 18, the growth in the Average Purchase Price effectively remained static with a 0.1% increase. This continues the trend of negative real price growth (growth less inflation) in the residential property market.

The Average Purchase Price recorded in Q3 17 was R1,192,868 against Q3 18’s R1,193,601.

Rhys Dyer, CEO of ooba, says: “The slowing in property price growth is a symptom of the slowdown in property demand due to economic constraints, socio-political issues and apprehension around the eventual terms of a National Land Reform Act.”

“The positive news about slowing property price growth is that property is more affordable for buyers, especially first time buyers,” he says. “Cheaper property prices, coupled with easier access to credit with lower deposit requirements from the banks, favour buyers.”

He says that banks are competing with each other by making loans more accessible and affordable, which signals their confidence in how consumers are managing their debt. This is illustrated in the significant increase of 4.6% in ooba’s Approval Ratio from 73.9% in Q3 17 to 78.5% in Q4 18. At the same time, the Average Approved Bond Size increased by 5% year-on-year and the Average Deposit as a Percentage of Purchase Price showed a significant decrease of 24% year-on-year.

Dyer welcomes the banks positive lending sentiment illustrated by the lower deposit requirement. “ooba is seeing an increasing trend of first-time buyers entering the property market who do not have access to a deposit. Our stats in Q3 18 show a growth of 7% in first-time buyers applying for finance with 100% bond applications increasing by 9% in this quarter.”

Buyers are also benefiting from the increasingly competitive interest rates from banks which are making home loans more affordable. ooba’s statistics for Q3 18 show that the average interest rate is 15 basis points cheaper year-on-year. The average rate that ooba achieved for its buyers in Q3 18 was 0.16% above prime compared to 0.31% above prime in Q3 17.

In this buyers’ market, Dyer recommends that prospective home owners prepare and empower themselves by obtaining a home loan pre-qualification through ooba’s Bond Indicator (OBI) and Qualified Buyers Certificate (QBC) products.

An OBI provides potential buyers with a clear online view of their credit score and credit profile, as well as a certificate outlining the house price range they can afford. The QBC increases the level of accuracy of the OBI, as the buyer’s information is checked and verified by an expert.

“Pre-qualified buyers understand their spending power and can confidently negotiate a satisfactory house price knowing that getting bond finance is a mere formality,” concludes Dyer.